National Bank of Hungary preview: Not a good time to be bold

This is not the right time for the Hungarian central bank to be taking big risks, in our view. Recent positive developments are still fragile and a misunderstanding might reverse the gains seen in early 2023. We see no change from policymakers this time

| 13% |

ING's callNo change in the base rate |

The rationale behind our call

The National Bank of Hungary made clear on several occasions that the temporary and targeted measures (introduced in mid-October) will remain with us until there is a material and permanent improvement in the general risk sentiment. This general risk sentiment is defined by a combination of external risks (war, global monetary policy, energy, general investor sentiment) and internal risks (Rule-of-Law procedure, current account imbalance).

If we take a quick overview of all the above-mentioned criteria, we get the general impression that there has been progress in several areas. The market is now generously looking through the final stages of major central bank tightening, and the focus is on the next big thing: the easing cycle. At the same time, risk-taking has started to build again, helping emerging market assets, including the forint. A large part of the relief rally is also coming from the recent drop in energy prices which has not only improved general investor sentiment but has also removed some uncertainty from energy-dependent countries like Hungary.

However, these improvements are not necessarily translating into better hard data, yet. The current account might improve going forward, thanks to retreating energy prices but hard evidence for such a change in the balance has been scant. The Rule-of-Law debate is out of the limelight now, but the government is still facing a long road to clear every hurdle before all possible EU funds are made fully available. The 2023 budget, however, shows clear optimism from the government’s side as the revenue side consists of roughly EUR 5.6bn (2.9% of GDP) of transfers from the EU.

On the macro front, economic activity looks to be more resilient than we thought earlier which might be a bit of a mixed blessing; a tighter-than-expected labour market and accelerating wage growth might raise questions about a wage-price spiral in Hungary. The latest developments in the labour market along with a better outlook for external demand (especially the Chinese growth story) lead us to revise our GDP outlook. We now expect 0.7% GDP growth in 2023, followed by 3.6% growth next year. Against this backdrop, we think the time is not right for any dovish pivot by the National Bank of Hungary.

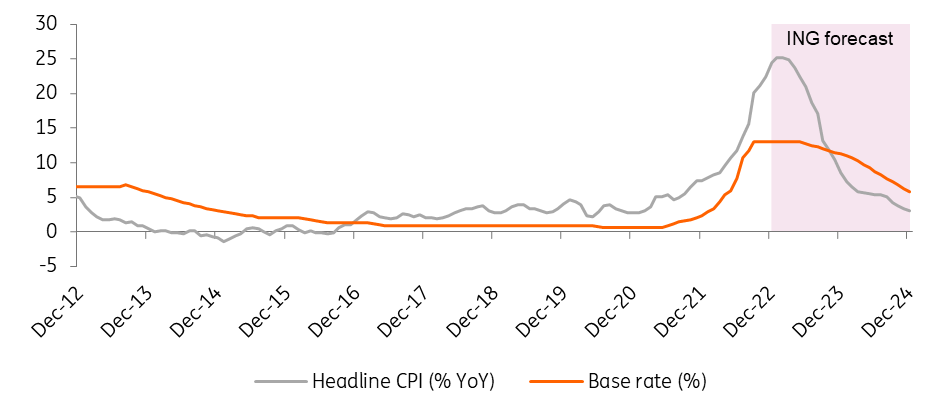

On the inflation front, the lower-than-expected December headline reading leads us to shift the trajectory of projected inflation lower, but this is still nowhere near a normal environment. We see an average inflation rate of 18.5% in 2023 with a peak of 25.2% being reached in January-February. Another factor behind our downward revision comes from anecdotal evidence that service providers and retailers see no further room (after the January repricing) to pass costs onto consumers as consumption is plummeting. We see upside risks, however, given the tight labour market, with strong wage growth further strengthening wage-push inflation. In our view, this could be a red flag when it comes to any change in monetary conditions.

ING's inflation and base rate forecasts for Hungary

At the next rate-setting meeting on 24 January, we see no change in the monetary policy setup. The base rate should remain unchanged at 13.00% with no change to the interest rate corridor either. The targeted, temporary measures will be continued by the central bank as well, as any abrupt change to the structure or to rates could reverse the gains made by the forint, which would hinder the central bank’s ability to reach the inflation target over the monetary policy horizon.

There is little doubt, however, that it might be worth testing the sensitivity of markets right now. References to a new, forward-looking, theoretical and conditional possibility of a turn in policy, either in the statement or during the press conference, could provide an opportunity to assess how far the market will allow the NBH to pivot, while avoiding serious and long-lasting damage in market stability. A trend-like change in external and internal risk sentiment could lead to a better situation by the time the March rate-setting meeting takes place. The next couple of months may allow enough time for the NBH to apply an adequate communication campaign to slowly prepare markets for an impending pivot and a gradual phase-out of the temporary, targeted tools.

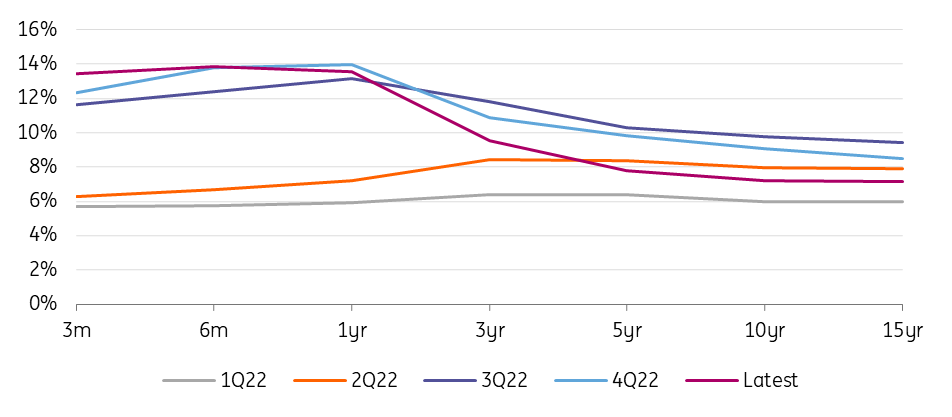

The main interest rates (%)

Our FX and rates call

Local rates have taken a quick path down since the start of the year following the global rally, and the curve has again steepened a bit. We expect this bias to continue. Although we expect the NBH to remain hawkish, monetary easing is the main theme for 2023. We do not expect the central bank to rush the first move, but the short end of the curve is still significantly elevated in our view, and the belly and end of the curve are already at fairer levels. Liquidity conditions in the market have improved slightly but still remain an obstacle for a strong view. Overall, we expect the whole IRS curve to move lower and steepen.

Hungarian yield curve

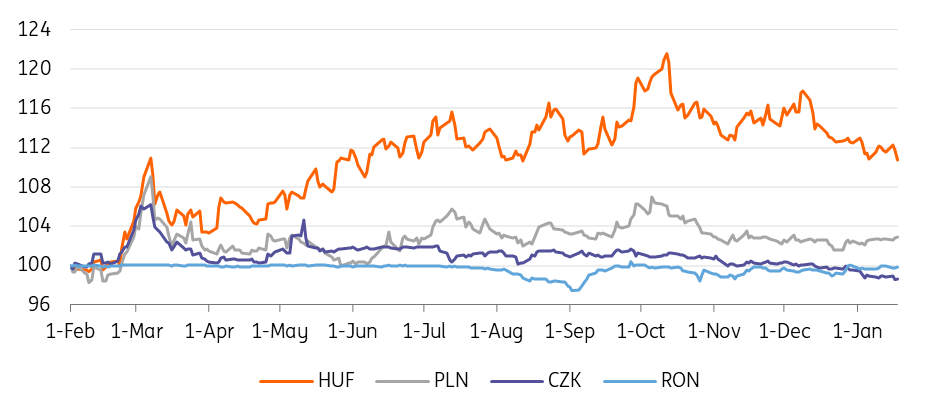

The forint became the star of the region in the first few weeks of this year, benefiting from the normalisation of the local story, especially on the EU front. But global factors are also playing strongly in the forint's favour. Together with the Czech Republic, Hungary is the biggest beneficiary of the current gas price decline, which should remain supportive for CEE FX at least in the first quarter. Moreover, at the global level, we think a further move higher in EUR/USD will keep emerging markets in favour. Overall, we thus expect the forint to still have a lot to offer and expect further appreciation. Carry remains by far the highest within the CEE region and the NBH seems to have finally found a way to keep liquidity conditions tight, making short positions expensive.

CEE currencies vs EUR (1 Feb = 100%)

On the other hand, the market has built up decent long positions over the past few weeks in our view, hence we expect the pace of appreciation to slow in the coming weeks. The risk for us is the NBH indicating a rate cut too soon, which some market participants are already expecting. However, a clear hawkish message from the NBH could add new support to the forint next week. We think there is a higher chance that the central bank will make yet another hawkish statement. The long-term deposit facility is an obvious tool to send such a message. The outstanding amount (HUF 2,135bn) is set to mature on 26 January but extending the facility could allow the Bank to send a strong signal that it will not change the 18% effective marginal rate.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap