Poland: Weak production as Eurozone sentiment worsens

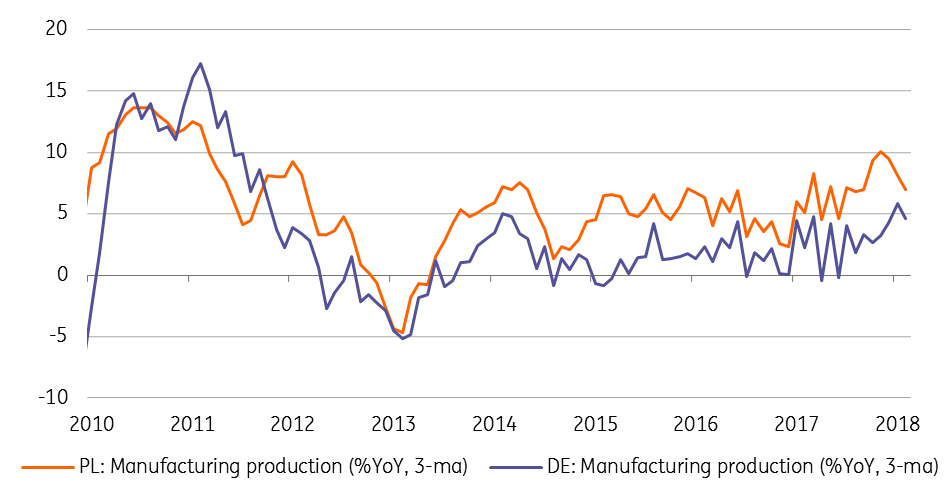

Industrial production surprised negatively due to sluggish export activity. The weakness reflects worsening sentiment in the Eurozone

| 1.8% |

Industrial production growth (YoY) in March |

| Lower than expected | |

Industrial production decelerated in March to 1.8% year-on-year (below the market consensus at 3% YoY) from 7.4%. The rapid slowdown was mainly related to statistical base effects – production growth in the same month a year ago was in the double digits. The negative surprise can be attributed to a moderation from last month’s growth leaders including:

- Export sectors i.e. manufacturing of computers (-7.8% YoY), machinery (-5% YoY). Output in these categories is strongly dependent on Euro-area sentiment, which deteriorated in 1Q18. So far we perceive this slowdown in the developed European economies as a temporary phenomenon and expect a recovery in 2Q18.

- Construction-oriented areas (i.e. production of non-metallic minerals -5.6% YoY). We expect a stabilisation of investment dynamics in the coming quarters after a rapid expansion in 4Q17, which should imply a similar trajectory in those manufacturing sectors.

Manufacturing production Poland vs. Germany (%YoY)

Construction output expanded at 16.2% YoY vs. 31.4% YoY in February (close to the market consensus). Similarly, as in previous months, the key contribution came from civil engineering (nearly 35% YoY) driven by public investment. Construction of buildings accelerated to 17.7%, which underpins strong demand in the real estate sector.

Overall the data provide no reason for the central bank to act on policy. Given the hike-averse MPC stance and risks related to external demand, we see flat rates in Poland at least until 4Q19.