Poland: Surprisingly low current account surplus in May’s balance of payments

After a long series of strong balance of payments data, the current account balance posting a minor surplus is surprising

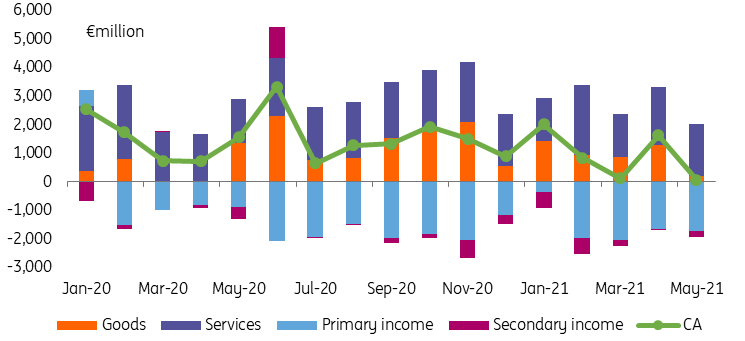

May’s surplus in Poland’s current account (just €0.06m) turned out well below market consensus of €1.5bn and our projection of €1.3bn compared to €1.6bn in April (revised). According to our estimates, the current account surplus calculated on a 12-month cumulative basis dropped from 3.2% of GDP in April to 2.9% in May. May’s reading takes into account a downward data revision, resulting from recently published quarterly data for 4Q20 and 1Q21. The quarterly data rely on reports from a much larger number of (mainly smaller) enterprises.

In its merchandise trade, Poland’s recorded a significantly lower surplus (€0.2bn) than in April (€1.3bn) and in May 2020 (€1.4bn). Growth rates of merchandise exports (42% YoY) and imports (54%), expressed in euro, turned out quite in line with our projection (we expected 44% and 51% YoY, respectively), though the divergence between the two was larger. Obviously, the high growth rates are a result of the low statistical base for May 2020. It is worth adding that import growth exceeded export growth for the first time since April 2020.

In the remaining current account components, Poland posted a traditionally high €1.8bn surplus in services, traditionally high deficit in primary income of €1.7bn and a deficit in secondary income of €0.2bn.

The strong rebound in imports results from a recovery in domestic demand after the removal of pandemic restrictions. The reading is an another signal – after the CSO data for GDP in 1Q21 – suggesting a negative contribution of net exports to Poland’s GDP growth in 2021. This means, that foreign trade will dampen rather than drive economic growth this year. This contrasts with the last year’s situation, when foreign trade acted as a shock absorber in the Polish economy.

The reading suggests a strong recovery in domestic consumption and likely rebound in investments in 2Q21. At the same time, it confirms a solid export performance given the relative revival in industrial production in the Eurozone in May, especially in Germany. In our view, the reading should be neutral for the zloty. Recently, the zloty exchange rate is primarily driven by global trends and monetary policy stance.

Poland: current account components in 2020-21

Download

Download snap