Poland: Solid labour demand, lower wages

February wage data missed expectations but the more relevant picture will come in March-April when large companies typically announce plans to raise pay

| 6.8% |

Wage growth (YoY) |

| Lower than expected | |

Wage growth in the enterprise sector decelerated in February compared to the previous month (6.8% YoY vs. 7.3% YoY), in line with market expectations. Detailed data on the structure of wages will be published within the next two weeks. The positive surprise in January was related to two sectors where jobs requiring lower qualifications are predominant: administration & supporting activities and accommodation and restaurants. Wage growth in industry and technological services surprised negatively. The persistence of that trend in February bodes ill for next month. We expect the March-April window (when large companies announce wage increases) to be crucial for the 2H18 outlook.

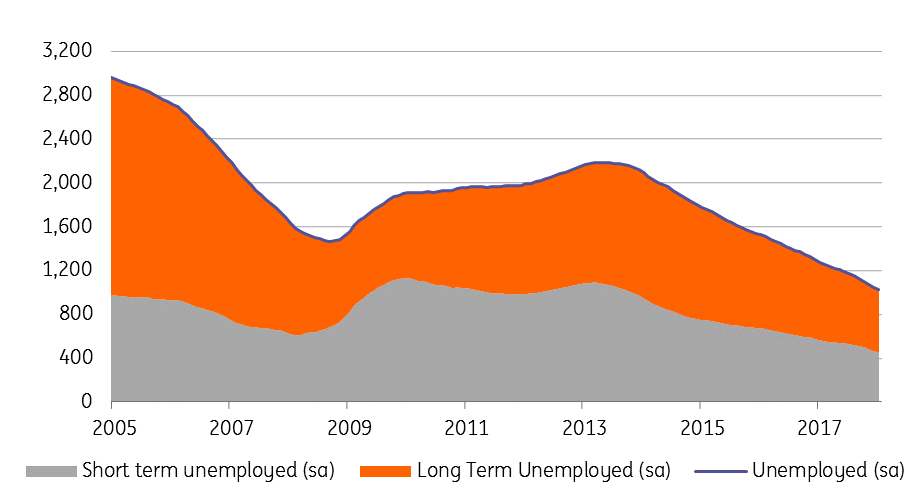

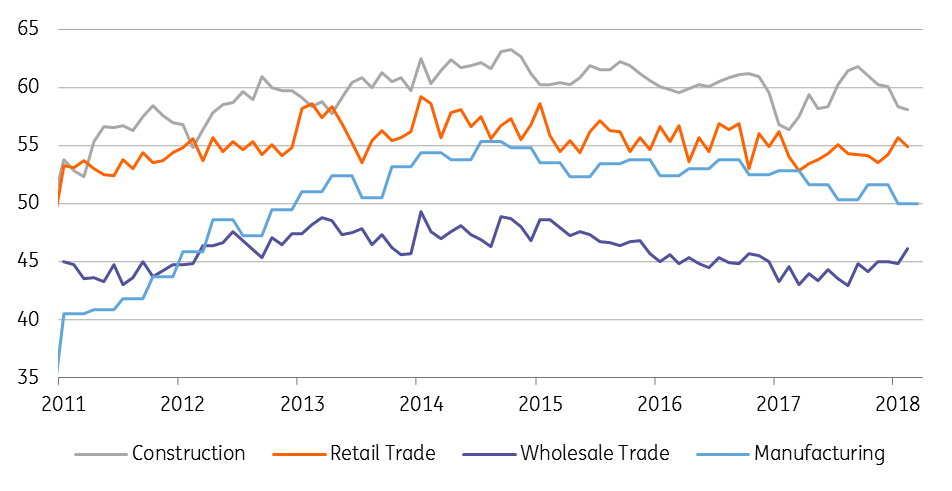

Enterprise employment decelerated by 0.1pp to 3.7% YoY, mainly due to base effects. Still, the number of vacancies remains at a historically high level. Similarly, business sentiment indicators show an increase in hiring intentions, especially in industry. That said, strong labour demand has been balanced so far by (1) an increase in activity of older workers (50+), including declining long-term unemployment (where the rate is close to historical lows) and (2) increasing migration from the East (Ukraine, Belarus, Georgia etc.). As such, the number of companies reporting problems with rising labour costs hasn't deviated from typical levels.

Number of vacancies remains at historically high level

Good labour market conditions induce activity of older workers and long term unemployed

Migration and better 50+ activity rate help reduce wage pressures

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap