Czech Republic: Optimistic beginning to 2018

January retail sales and industrial production figures were anything but disappointing, which is why we think the Czech economy has entered 2018 in solid shape

Solid industrial figures in January

Industrial production accelerated by 5.5% year-on-year, fully in line with market expectations. The manufacturing industry itself accelerated by 9.6%, which is well above the 2017 average of 7%.

But total January industrial production was weaker due to the 16% YoY drop in energy production driven by a warmer than average January. The same reason was behind the somewhat weaker industrial figures from Germany and the Eurozone this year.

| 5.5% |

January industrial production (YoY) |

| As expected | |

Automotive segment expected to slow industrial production

The short-term prospects for the industry remain favourable, which confirms the new orders and the high indicators of the purchasing managers. Even without US tariffs, there is also a risk of a gradual slowdown in the pace of car production.

The motor vehicles segment rose just by 5.4% in January, compared with the double digit-growth in last four years. In such a situation, the question of a slowdown is relevant and also signals the weaker growth of new orders in the automotive industry, which just stagnated in 2017 and further declined by 1% in January.

Thus, the two-digit growth of the automotive sector is likely to be over, although production will remain strong, the annual growth rate will slow down this year. This is the reason, why we expect industrial production to slow down this year after its solid almost 6% growth in 2017.

| 8.2% |

January retail sales (YoY) |

| Better than expected | |

An overheated labour market behind the strong retail sales?

On the other hand, retail sales (excluding the automotive segment) rose by 8.2% year-on-year in January, significantly exceeding the 5.6% average of 2017.

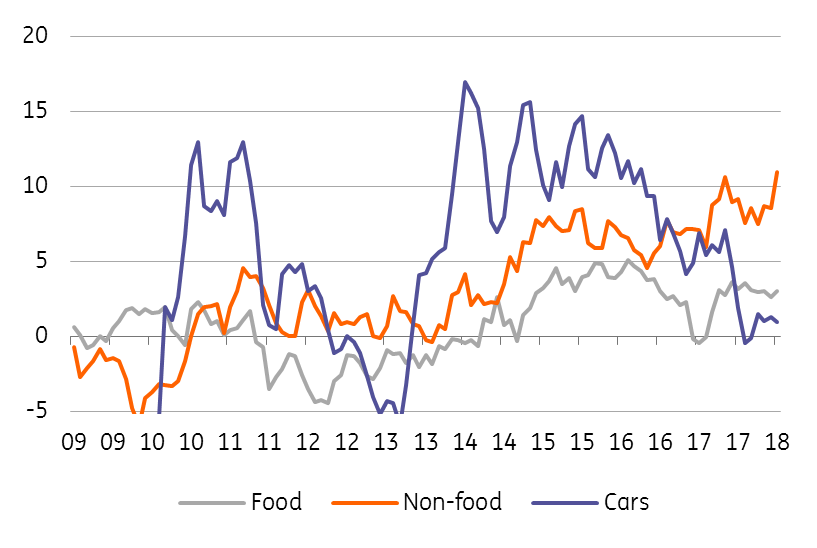

While growth in food sales continue at a moderate pace of around 3%, sales dynamics for non-food items accelerated by 12% in January. This is the fastest January pace since 2005. Retail sales in the car segment were beginning to slow down last year, and January print confirmed this trend further, as motor vehicle sales rose just moderately about 1% YoY in January.

Czech retail sales

(%YoY, 3M average, working day adjusted)

Households consumption will be the main growth factor this year

All in all, retail sales in the Czech Republic were surprisingly strong at the beginning of the year, confirming solid consumer sentiment of Czech households.

This is driven by an overheated labour market leading to wage acceleration. Indeed, wages picked up by seven percent in nominal terms last year and further acceleration is expected this year. The first sign is the almost 10% YoY wage growth in industrial companies in January. With inflation close to 2%, real wage growth around 6% YoY will be the significant driver of households consumption.

Thus, this will be the main factor of the Czech economy growth this year, together with renewed investment activity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap