Poland: July retail sales and construction disappoint

July retail sales fall unexpectedly (down 1.5% Month-on-Month after seasonal adjustment). We think that this reflects shifting consumer preferences (from purchasing goods to buying services). Construction was dragged down by a slowdown in infrastructure investment, something which should prove temporary.

| +3.9% YoY |

Retail sales in JulyConsensus at +4.9% |

| Worse than expected | |

In July the growth of retail sales dropped from 8.6% to 3.9% YoY. This was significantly below expectations of 4,9% YoY. Deterioration was recorded for most sales groups with the exception of foods. Auto and furniture sales fell 2.9% and 1.9% YoY, respectively. The first one likely due to supply issues.

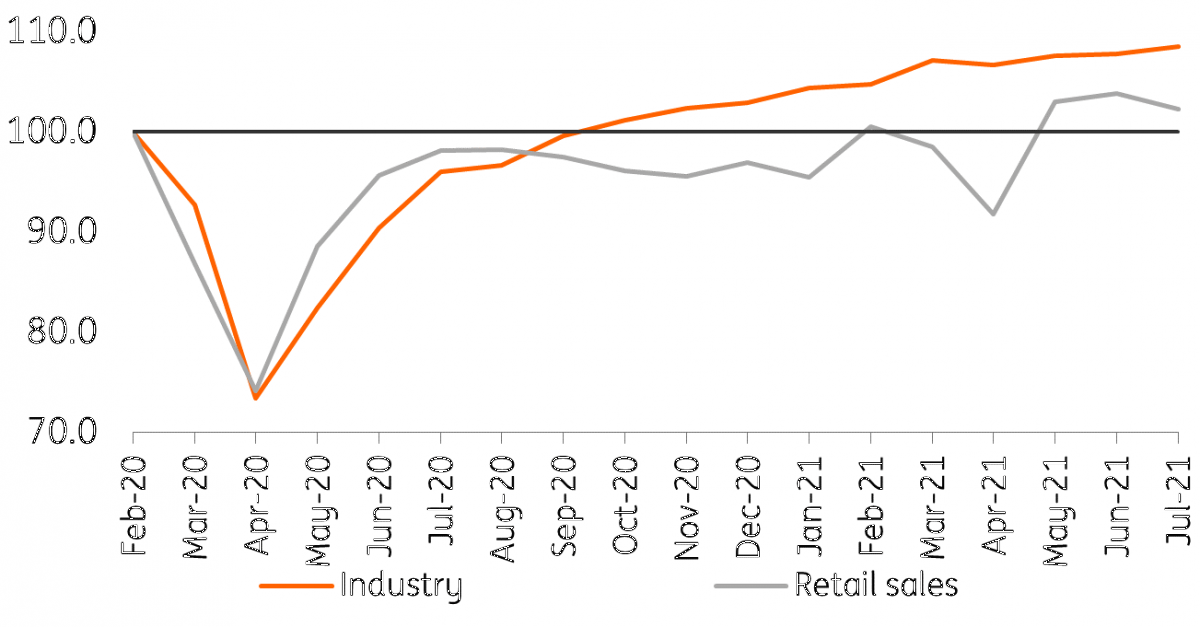

As the economy opens up, retailers must increasingly compete with service providers. The seasonally adjusted retail sales in July fell by 1.5% MoM after a 0.8% increase in June. This indicates a pause in the sales recovery after the pandemic. Moreover, the change in sales was significantly below the monthly growth in industrial production. At the beginning of 3Q21, industry not retail took over the engine of growth in Poland.

Industrial production and retail sales (February 2020=100).

The pent-up demand effect in trade is no longer present. Consumers seem less willing to spend savings on goods which are getting more and more expensive. In our view, they have also shifted some demand to services, especially in travel and leisure.

| +3.3% YoY |

Construction in JulyConsensus at 7.1% |

| Worse than expected | |

July's construction and assembly production disappointed again after weaker-than-expected results in June. Production growth slowed down from 4.4 to 3.3% YoY, compared to 7.1% expected by the market.

In July, weaker results were recorded in infrastructure works (-5.9% YoY compared to +0.4% in June). This is most likely due to a slowdown in railroad tenders after the European Commission challenged the law which prevents participation of civic organizations in the railroad investment process. After this act is amended, investments in this area should accelerate.

On the other hand, the construction of buildings came as a positive surprise. Here, output increased by 5.7% YoY after declines of 0.3% in June and 5.7% in May. This is driven by demand for new apartments as households are looking for opportunities to protect their savings against inflation. However, developer activity is already at historically high levels, which will limit construction output growth in this segment in the coming months.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap