Poland: No change in rates, low risk of spillover

As expected, rates remained unchanged, but the recent problems in emerging markets should have a limited impact on the central bank's monetary policy. We expect MPC to maintain flat rates till the end of 2020

Poland's central bank left interest rate unchanged at 1.5% in line with broad consensus expectations. The shift in policy stance during the press conference is unlikely. We expect Governor Adam Glapiński to reiterate his forward guidance, that rates should remain flat till the end of 2020.

The press conference is likely to be dominated by questions about the risk of spill-overs from the emerging market crisis, e.g. Turkey, Argentina or the Asian economies. Given that, economic ties with these countries are limited; we think the MPC is likely to emphasise it should be low risk.

The strong argument supporting the current policy stance is moderation of GDP growth. We expect deceleration from 5.1% year on year in 1H18 to 4.4%YoY in the second half of the year and 3.7%YoY in 2019. The surprising drop in investment dynamics in 2Q18 from 8.1 to 4.5%YoY is also concerning, even though the change of accounting rules explain some of it particularly with regards to military spending.

Secondly, the MPC should take into account the risk of undershooting the CPI target in 4Q18. We expect a drop in inflation to be approximately around 1.0%YoY in November reflecting low core inflation and deceleration of food and fuel prices’ dynamics. The weakness of inflation is temporary – our forecasts indicate a return to 2%YoY in March 2019 due to an increase of electrical energy tariffs and expiration of negative regulatory factors lowering core inflation in 2018.

Still, the MPC should claim that inflation remains under control and risk of overshooting the Bank's target in 2019 are limited.

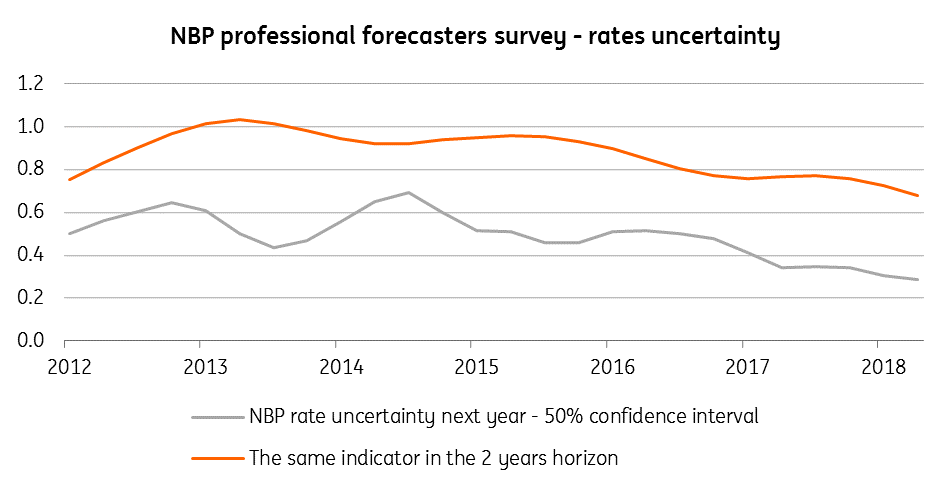

Interest rate forecast uncertainty - NBP survey (trend)

We expect the MPC to maintain flat rates till the end of 2020. The consensus of local economists is converging towards this forward guidance. According to the Polish Press Agency 50%, of poll participants project no rate change till the end of 2019 (longest forecast horizon). Lower uncertainty is visible also in the NBP forecast from Survey of Professional Forecasters.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap