Hungary: Long, slow summer in industry

Industrial production disappointed again, showing a new pattern of summer shutdowns mainly in car manufacturing

| 3.9% |

Industrial production (YoY)Consensus (8.0%) / Previous (3.0%) |

| Worse than expected | |

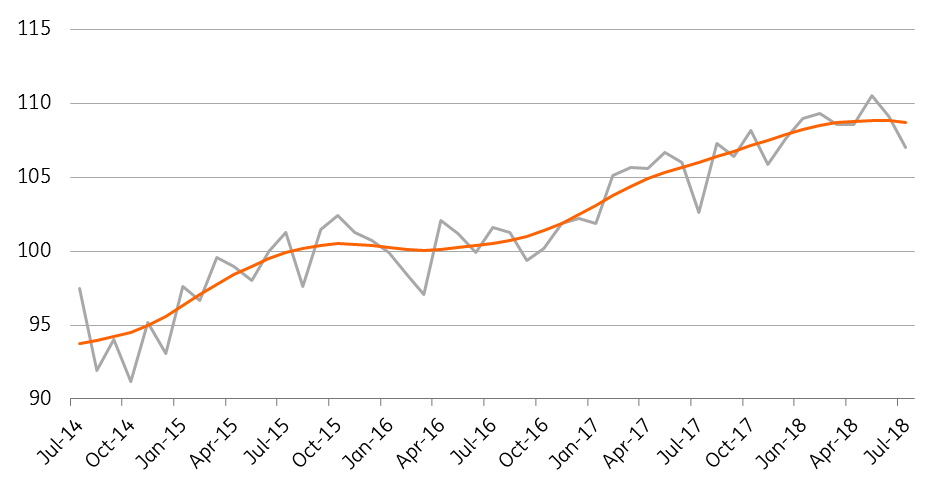

Industrial production – based on working-day adjusted data – increased by 3.8% year-on-year in July, well below market expectations. It counts as another disappointment after retail sales data, so the third quarter has been full of downside surprises, so far. Another parallel between the retail sector and industry is that in both sectors the fixed-based volume index (2015=100%) has been dropping for three consecutive months. However, we can find a silver lining: the volume of production is still well above the 2015 level. Against this backdrop and considering the finer detail of the 2Q18 GDP reading, we assume that the Hungarian economy has passed its peak in the current growth cycle.

Volume index of industrial production (2015 = 100%)

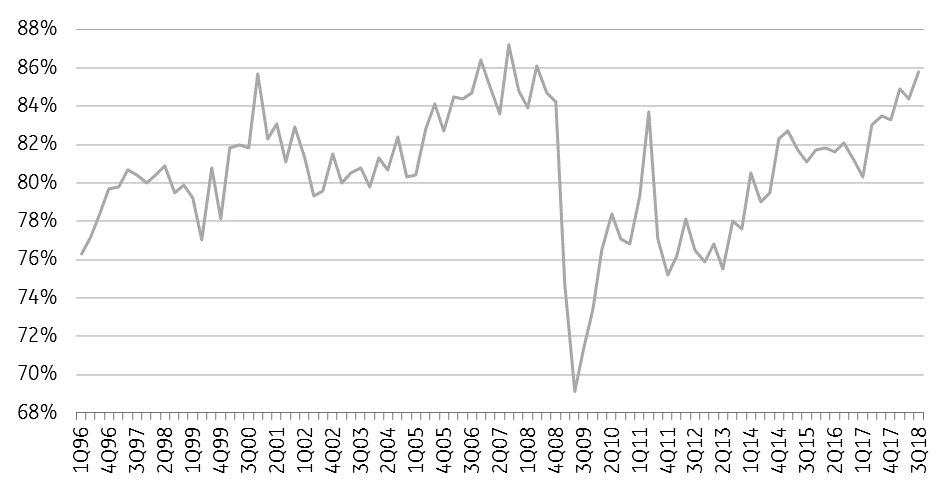

The Hungarian statistics office highlighted in its commentary that industry saw a significant contribution from electronics combined with an average performance from the food industry. The downward surprise comes from car manufacturing, as production dropped. A possible explanation could be the new summer holiday pattern. In previous years, August was the time when multinational manufacturer shutdowns took place. Since last year, it seems that the shutdown period has been prolonged, stretching from June (weak) to July (weaker) with a correction in August (rebound). In addition, industry has also hit capacity constraints. According to the latest Eurostat survey, capacity utilisation reached 85.8% in 3Q18, the fourth highest reading of all time.

Current level of capacity utilisation

When it comes to the rest of 2018, we expect a mild improvement from August, mainly due to the abovementioned seasonality and production of Audi’s electronic motors. However, as Volkswagen Group has a lot more to do with type approvals, it will lead to decreasing production and cutting working hours. So far, we have no insight into which effect will be more decisive. Nevertheless, we maintain our forecast of a 4% YoY industrial growth in 2018 as a whole.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap