Polish manufacturing continues to grow despite cost pressures

Thanks to the re-opening of the economy, production in Poland saw strong growth in May in spite of the record supply chain disruptions generating increasing cost pressures. We expect average annual CPI to amount to 4.3% YoY in 2021 and 3.8% YoY in 2022

| 29.8% YoY |

Industrial production in MayConsensus at 29.0%YoY |

| Better than expected | |

In May, Polish industrial production grew by 29.8% year-on-year, after the record +44.5% YoY growth in April.

The year-on-year output growth was mainly due to the low 2020 base, which is why seasonally adjusted month-on-month dynamics are a better indicator of the momentum in the economy.

The consensus was at 29.0%, and even the highest forecasts ca. 35% YoY.

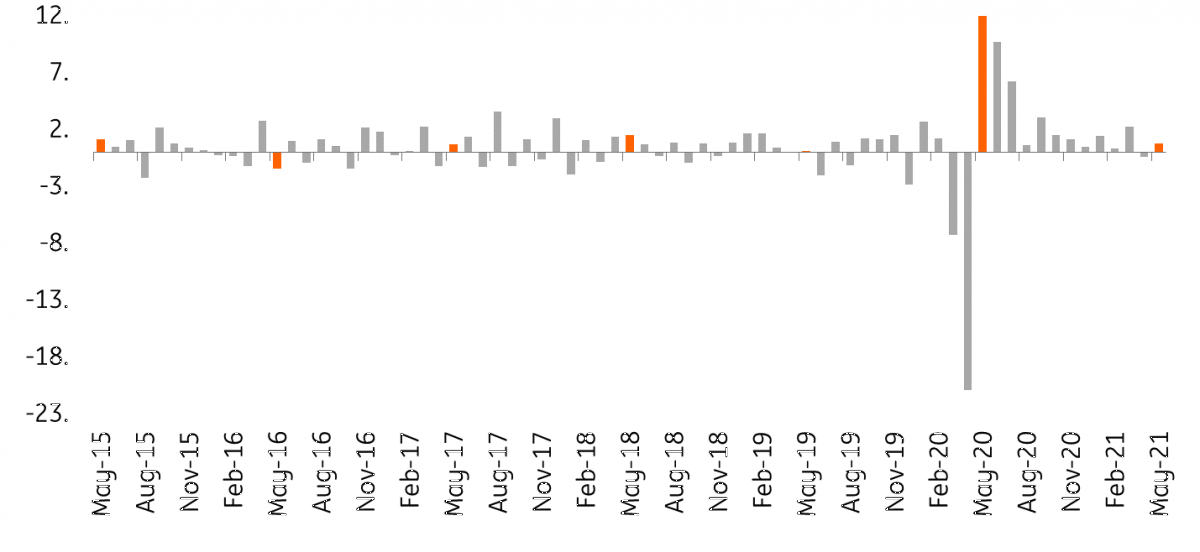

Industrial production (%MoM, seasonally adjusted)

On a seasonally adjusted MoM basis, manufacturing grew 0.8% compared to a 0.4% decline in April. This is a relatively good performance, although the rebound could have been stronger. The rebound from the re-opening of the economy in May was offset by record supply shortages in manufacturing companies, and the MoM data shows that the disruptions were most pronounced in car manufacturing (drop by 9.1%MoM).

Nonetheless, this is still good data and soft indicators e.g. PMI, growth in domestic orders, point to a strong rebound in the coming months.

Manufacturing: Shortage of equipment and raw materials act as a barrier

In year-on-year terms, high growth rates against the lows seen in May 2020 are seen in the production of motor vehicles (+103.9% YoY), computers (+70.2% YoY) and furniture (+41.8% YoY). Export sectors continue to benefit from the worldwide shift in demand to durable goods supported by the global and domestic economic recovery in recent months.

CSO data shows a continued rebound in production of durable consumer goods (+49.4%YoY), capital goods (+51.3%YoY) and intermediate goods (+34.2%).

The re-opening effect and associated disturbances in the demand-supply balance have been followed by strong cost pressures in companies, which has led some to raise prices.

In May, Polish PPI inflation accelerated to 6.5% YoY from 5.5% YoY in April. Prices in manufacturing accelerated strongly to 6.3% YoY from 5.3% in April. The current cost-driven nature of inflation in Poland should soon have more demand-driven sources. In our opinion, we should see a stronger rebound in consumption in the second half of 2021. Demand pressures in 2022 are likely to be strengthened by the Keynesian effects of the Polish deal financed by the EU Recovery Fund.

We expect the average annual CPI to amount to 4.3% YoY in 2021 and 3.8% YoY in 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap