Poland industrial production remains resilient despite European slowdown

Industrial production in Poland remains firm despite a slowdown in activity in Germany and the UK at the beginning of the year

| +0.9% YoY |

Industrial production in JanuaryConsensus at +1.0% YoY |

| Lower than expected | |

In January, industrial production in Poland increased by 0.9% year-on-year compared to the 11.2% strong growth seen in December and the consensus at +1.0%.

The slowdown in the growth is affected by the unfavourable pattern of working days. While in December we had two more in YoY terms, in January there were two fewer days. Adjusted for seasonal factors, the year-on-year growth of production in January (5.7%) was still very strong, close to that of December, and even higher than the 4Q20 average.

In month-on-month terms, production continued to expand by (+1.7%) and is now nearly 5% above the pre-pandemic level of February 2020.

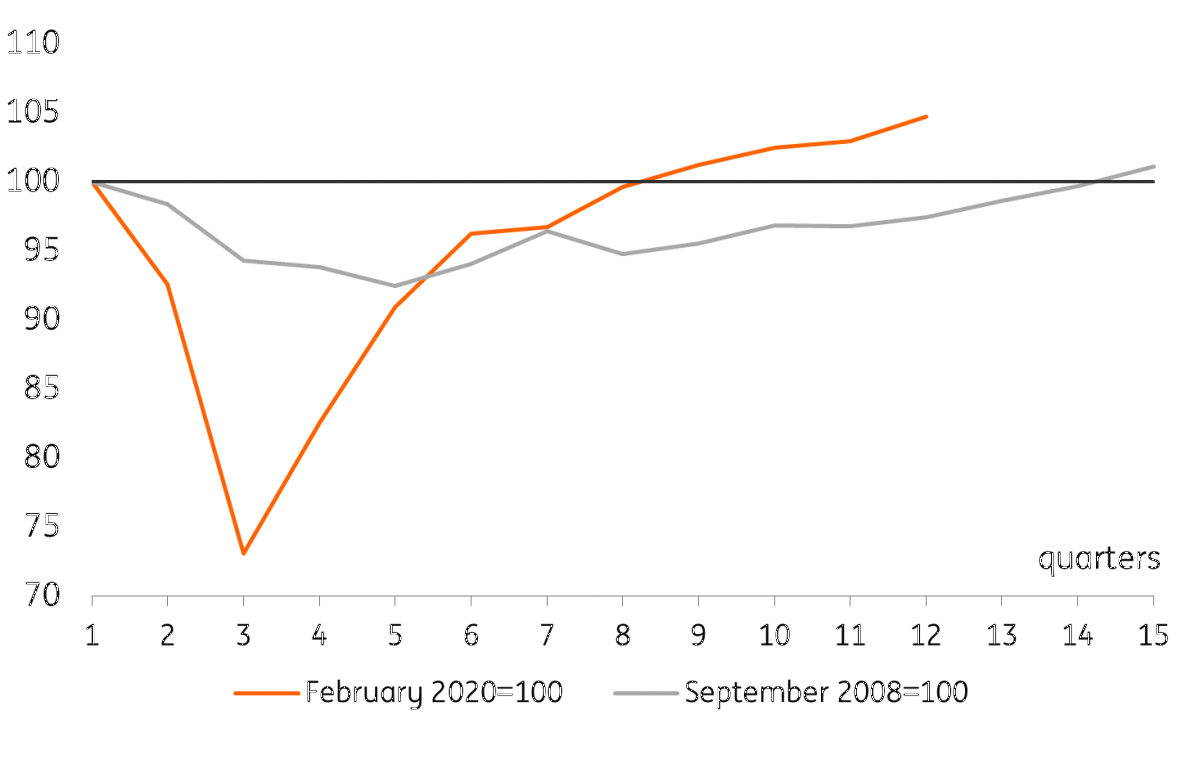

Pace of industrial production recovery after the crises of 2008 and 2020.

The structure of production shows export sectors such as the manufacturing of computers, electronics, optical products, electrical equipment, rubber and plastic products continued to grow YoY. However, the scale of this growth, due to unfavourable weekday patterns, is much lower than in December.

In January, the production of capital goods declined slightly (by 1.3% YoY) following a strong (9.8% YoY) increase in December. This is largely due to calendar effects. The production of intermediate goods (+4.4% YoY) and consumer durables (+3.7% YoY) increased.

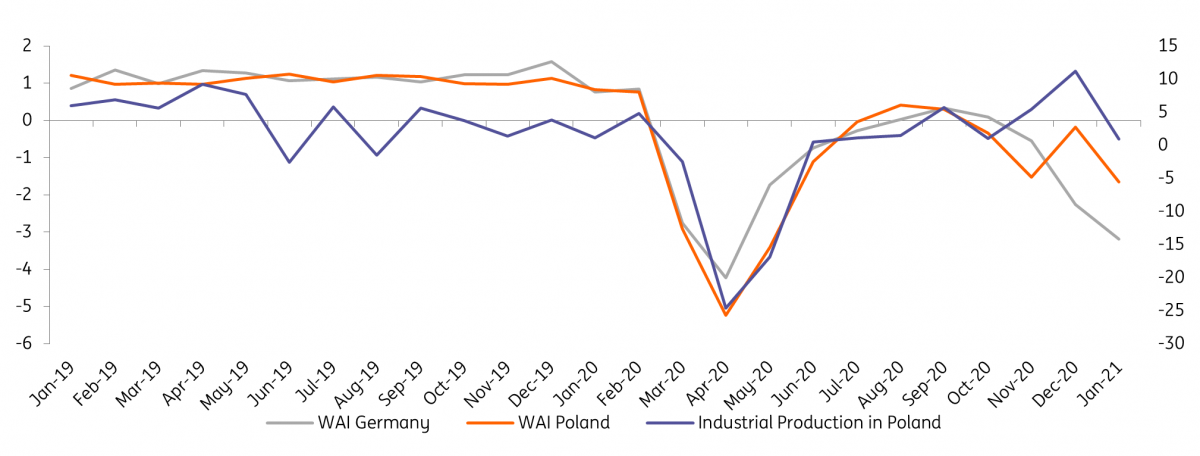

Soft data, such as business sentiment indicators, pointed to a relatively good situation in Polish industry in January. Their readings improved slightly compared to December. This was also confirmed by short-term economic activity indicators (WAI) based on population mobility and daily industrial indices. They suggested that activity in Poland was still relatively good in January, and even grew slightly in early February, despite the simultaneous slowdown in Germany and the UK in 1Q21.

ING WAI (Germany and Poland) and industrial production in Poland

In Germany, Poland's largest trading partner, these indicators fell sharply.

Weaker activity there was caused by the extension of the lockdown, reinforced by the negative effects on supply chains associated with Germany's border controls, which may reflect in weaker Polish activity. There is also a risk of a third wave of the pandemic, which is why we are cautious in our 1Q21 forecasts.

For the last few months, we have assumed a slight dip in GDP (QoQ terms) in 1Q21 but activity should rebound after restrictions are eased.

However, our 4.5% YoY GDP growth forecast for Poland in 2021 is still valid, but slower vaccination progress means the rebound in 2Q21 could be milder, with most of the recovery shifting to 2H21. The EU is doing its best to ensure a bigger supply of vaccines, starting in 2Q21.

The aim is to replicate the vaccination successes seen in the UK and US. Hence the recovery in Europe and Poland is shifting to 2H21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap