Poland: Industry gearing up before second wave of pandemic

Industrial output in October grew by 1.0%, down from 5.9% year-on-year in September. The recovery after the first Covid-19 wave has faded, but production is still 1.2% higher than in February. This reflects a recovery in global manufacturing and a generous fiscal package domestically

| 1% |

Production growth in October in Poland (YoY)In line with market expectations |

| As expected | |

Covid impact to be less severe than before

On a monthly basis (seasonally adjusted) industrial production grew 1.6%, down from 3.0% a month prior. Industry is yet to suffer the impact of the second Covid-19 wave and new restrictions. This should occur in November and December, but to a lesser extent than in services.

Our index gauging restrictions and mobility in Poland indicates that the Covid-19 impact is stronger compared to the 2Q20 average. However, we expect the impact of the pandemic on industry to be substantially less severe than in the spring. New restrictions, both globally and domestically, primarily impact services requiring direct personal interactions. The authorities are trying not to disrupt production chains, as reflected in the relatively upbeat industrial sentiment. The economic recovery in Asia also offers support. We estimate that the scale of the GDP downturn in 4Q20 should reach half to one third that seen in 2Q20, as the economy remains supported by robust spending.

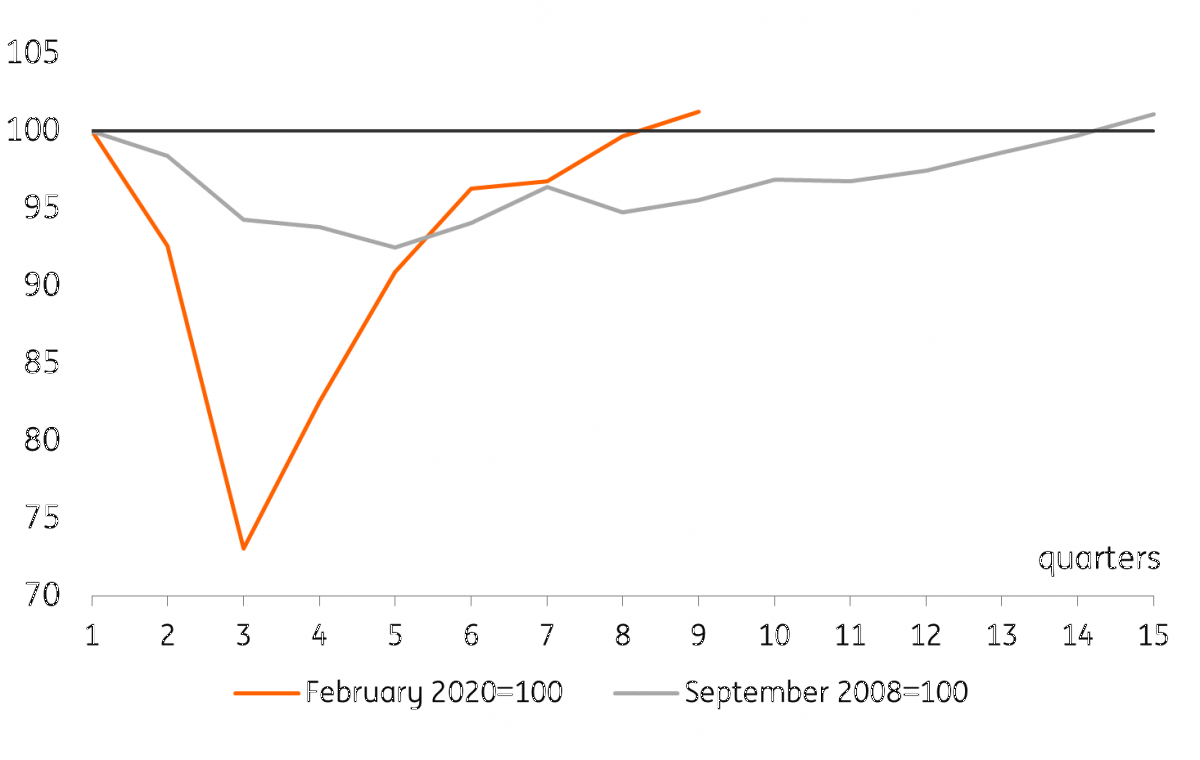

Speed of industrial production recovery after the 2008 and 2020 crises

The slowdown in industrial production in October primarily reflects one working day less than a year prior. Nonetheless, production of durable consumer goods retained a strong performance (7.8% YoY), but was still weaker compared to September (21.2% YoY). Production of energy related and investment goods declined in year-on-year terms (respectively by 7.8 and 1.4%). The decline of the latter indicates that domestic investment demand is weak and is unlikely to recover before the second half of next year.

Download

Download snap