Poland: Industrial growth slows; PPI inflation turns around

Industrial output growth moderated in October amid declines in energy production, but manufacturing continued to expand at a solid pace. PPI inflation, which we believe has now peaked, slowed further. The coming months will bring a further deterioration in industry, including in manufacturing, and the downward trend in PPI growth should continue

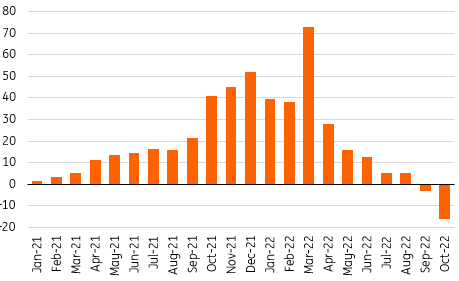

Softer energy production pulling down industrial output growth

Industrial production rose by 6.8% year-on-year in October falling short of our estimates and market expectations (ING: 8.8% YoY; consensus: 8.1% YoY), after an increase of 9.8% YoY in September. Seasonally-adjusted output contracted by 0.3% month-on-month. Output growth in manufacturing remained solid (9.3% YoY vs. 11.0% YoY in September), but energy production slowed markedly (-16.2% YoY). Signs of weakening are also slowly becoming apparent in manufacturing as well, though. The positive effect of improving global supply chains, which reduced the backlog of work, is beginning to fade. Manufacturing is starting to experience softer demand (decline in new orders). In other words, the negative demand effect is starting to dominate the temporary positive supply impulse. Production growth in the automotive industry went up by 41.6% YoY vs. 46.5% YoY in September and was 5.2% lower than in the previous month.

Energy output declines from high reference base

Electricity, gas, steam and air conditioning supply, % YoY

In the short term manufacturing growth also expected to moderate

Poland’s industry was quite robust in 3Q22, driven by an improvement in global supply chains, but October might have been the last month of significant annual output growth. In the coming months, overall production is expected to suffer from a high base from last year's impressive (and hard-to-explain) output growth in the energy production section. Also, manufacturing should slow as orders have weakened, so the turn of 2022 and 2023 should be weak. However, 2023 should not be as dire as the most pessimistic expectations indicate. There is a certain breath of optimism in the economies of our trading partners thanks to the fall in gas prices and significant fiscal stimulus in Western Europe, and perhaps Poland.

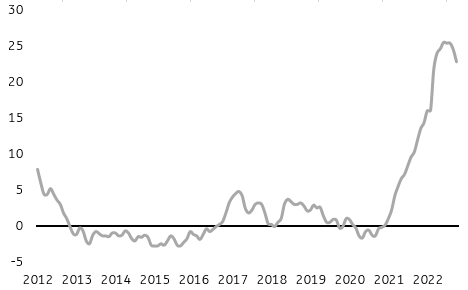

Producer price growth slowing down

Producer prices (PPI) rose by 22.9% YoY last month (ING and consensus at 23.5% YoY) following a 24.6 YoY increase in September. Prices in manufacturing rose by 1.4% on a monthly basis, while there was a marked decline (4.5% MoM) in the energy generation section (for the second month in a row). The peak of PPI inflation is probably behind us, due to declines in commodity and energy prices and the high reference base. But the process of passing on higher costs to the customer is far from over and should be continued for some time.

Producer price inflation has turned around

PPI, % YoY

The Polish PPI shows the green shoots of global disinflation. However, central banks in developed markets say it would be premature to declare victory over surging inflation. The economic situation in the US and Europe is not weak enough, labour markets are strong and policymakers are willing to continue hiking rates, albeit in lower increments.

Outlook for economic growth rather poor

In 3Q22, GDP growth was in line with our forecast (3.5% YoY) and we are on course to reach around 5% growth in 2022 as a whole. It should be noted that while growth exceeded 8% YoY at the beginning of the year, it slowed to around 3% in the second half of the year. The inventory cycle played a large role in this. We expect visibly slower annual growth figures with respect to household consumption and fixed investment in the second half of 2022. High prices, rising interest rates, elevated geopolitical uncertainty and deteriorating external demand also contributed to the GDP slowdown in Poland.

In 2023, we will see economic growth slowing down to around 1%. Theoretically, the weaker economy will be conducive to disinflation, but we forecast that average annual price growth next year will still remain in double digits. Persistently high core inflation is particularly worrying and indicates that the 2021-22 increase in energy prices will still translate strongly into growth in retail prices.

Interest rates to remain unchanged in the short term

The MPC has completed the current cycle of hikes and further increases are unlikely until late 2023 when we see the NBP resuming its tightening cycle. Should the pace of disinflation turn out to be slower than envisaged in the November NBP projection, or new forecasts point to stubbornly high inflation in 2024, policymakers could decide to tighten monetary policy even more.

Download

Download snap