Poland: GDP in 2020 not as bad as initially feared

The pandemic and related restrictions last year led to the first fall in GDP since 1991, a drop of 2.8% YoY. However, this was shallower than initially feared and the previous contraction of 7% in 1991, at the beginning of the transition. In relative terms, this is a good result, as the world economy is experiencing its worst crisis since the World War II

| -2.8% |

GDP drop in Poland in 2020 (YoY) |

According to preliminary estimates by the Central Statistical Office, real GDP in Poland fell by 2.8% year-on-year in 2020. We estimated -2.7%, while the consensus called for -2.6/-2.7%. Over the full year, household consumption fell by 3% YoY (we estimate that in 4Q20 it fell by ca. 3% YoY - only one third of that in 2Q20). Investment fell by 8.4% YoY over the whole year, which translates into a decline of -10.7% YoY in 4Q20 (-9% YoY in 3Q20). Net exports provided strong support to GDP, as reflected by the rebound in manufacturing in 4Q20.

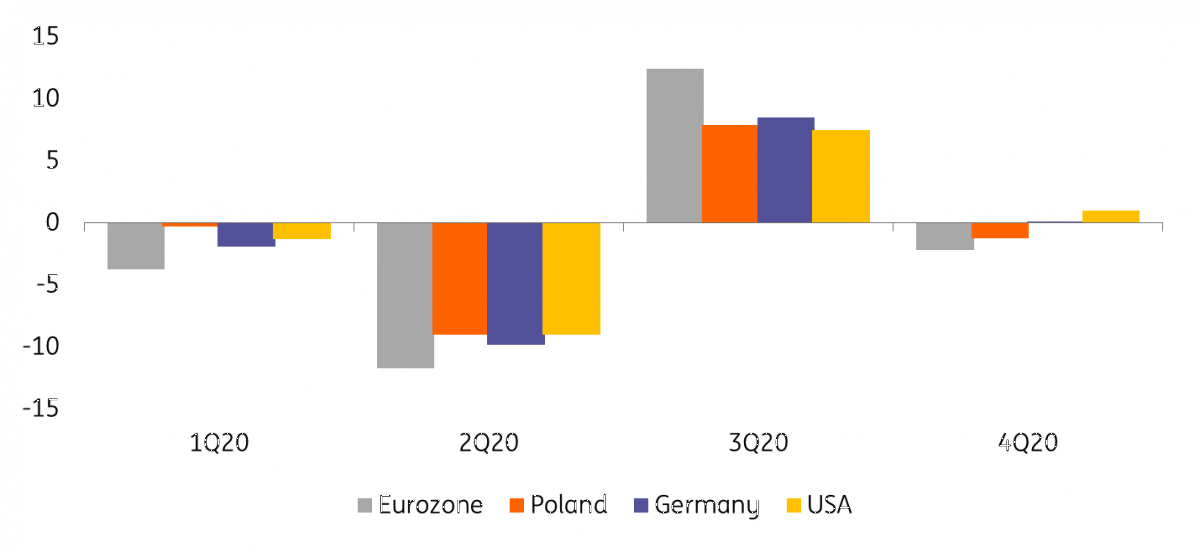

As in other countries, 4Q20 showed a diminishing impact of the pandemic on GDP. Economies, supported by huge fiscal packages, have adjusted to administrative anti-pandemic constraints. While the number of Covid cases during this period was much higher than in the spring, our index of economic restrictions indicates that those associated with the second wave of the pandemic in Poland were a quarter to a half less onerous. In addition, the resilience of the economy to the restrictions is growing. We estimate that the quarter-on-quarter contraction of GDP in 4Q20 was only about a tenth of that in 2Q20 (-1.2% quarter-on-quarter in 4Q20 vs. -9% QoQ in 2Q20), which was also supported by the global economic environment.

Quarter-on-quarter changes in GDP: Poland in comparison to selected economies

We estimate that in 2021, GDP in Poland should make up for the pandemic losses. While the seasonality of regular flu, slow vaccination progress, and new Covid-19 mutations (which caused extended hard lockdowns) call for a cautious outlook in 1Q21, we still expect GDP to rebound, as of 2Q21. Achieving herd immunity might take longer than previously expected, but as soon as the vulnerable parts of the population are vaccinated, governments will be pushed to lift restrictions. This should trigger a rebound in consumer demand. Household savings have increased strongly during the pandemic and spending this money will result in a strong rebound in consumption and GDP. On average, we estimate that household consumption could grow by 5.0% YoY in real terms in 2021.

The prospects for private investment are worse and without this, the growth structure will be pro-inflationary. Private investment as a share of GDP in Poland has been below the EU average for years, and in 3Q20, reached the lowest level as a percent of GDP in recent history. Although we expect private investment to increase YoY starting as early as 2Q21, this will be largely due to a low base. In our view, investment demand will not return to the 4Q19 level, i.e. the pre-pandemic period, until the second half of 2022 at the earliest, unless there is a significant acceleration in spending of EU funds. Public investment, financed with the disbursement of EU funds from a 2014-2020 financial standpoint, should keep growing at a single digit pace. In terms of GDP growth, we estimate it to be 4.5 YoY in 2021, supported by a low base effect from 2020 and a rebound in private demand.

Download

Download snap