Poland: Core inflation continues to rise at a strong pace

The StatOffice confirmed its estimate of October CPI at 17.9% year-on-year. We estimate that core inflation rose to 11.2% from 10.7% YoY in September. Our concerns about high core inflation are shared by economists at the National Bank of Poland. Despite this, the MPC has decided to essentially end the rate hike cycle

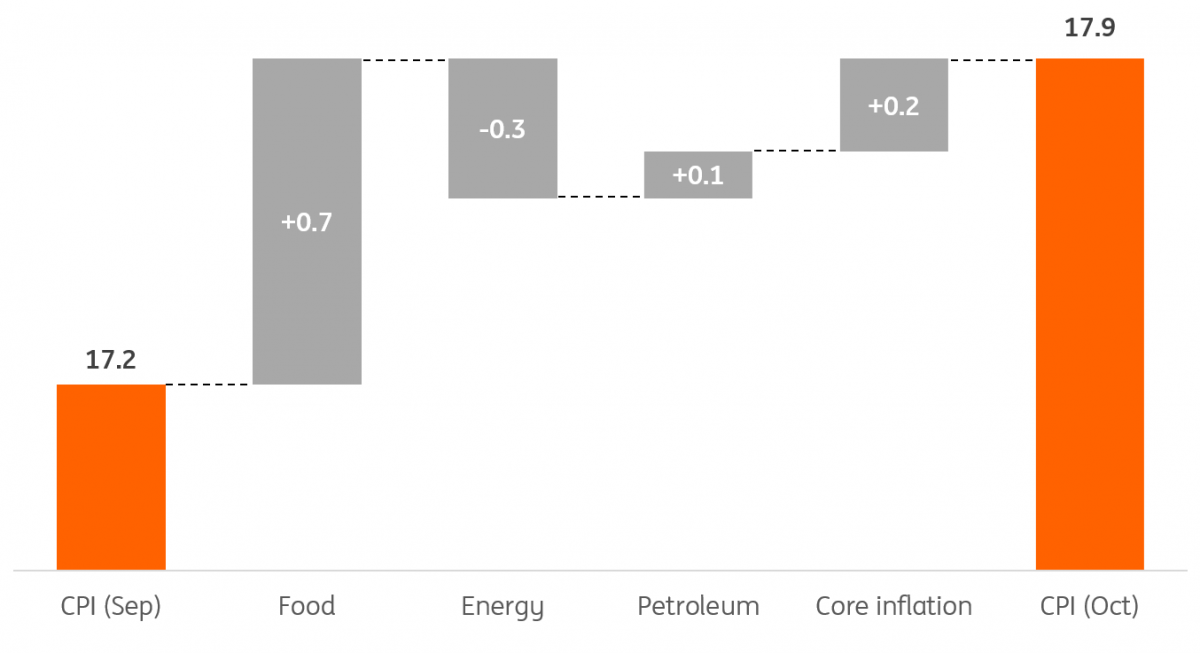

We already knew from the flash CPI estimate that the significant increase in food and fuel prices was mainly responsible for the increase in inflation last month relative to September. On the other hand, there was slightly less pressure from energy carriers, as prices grew at a slightly slower rate (1.9% month-on-month) than in August and September, mainly due to the deceleration of coal price increases. This does not change the fact that energy carriers are now more than 40% more expensive than a year ago, despite the Anti-Inflation Shield (VAT and excise tax cuts) covering electricity, gas, thermal energy prices, and the freeze on regulated prices through 2022.

CPI increase in October vs. September mainly stemmed from upswing in food prices

% YoY, percentage points.

We are now seeing the effects of the energy shock (more expensive fuel and energy carriers), but the most worrying phenomenon is the propagation of this shock in the economy and the increasing spillover of price increases due to secondary effects. Rapidly rising core inflation confirms that the impulse from this side is strong, and its impact on prices may be long-lasting. Based on the CPI structure data in October, we estimate that core inflation rose by about 1.1% MoM to 11.2% from 10.7% YoY in September.

Our concerns about the high core inflation and the spillover of price increases across the economy are shared by economists at the central bank. In its November projection, the National Bank of Poland said that high inflation expectations of companies and households translate into increased acceptance of price increases in many sectors of the economy, increasing its persistence. At the same time, the minutes of the October meeting noted that in light of the inflation expectations of companies, households, and professional forecasters, the level of real interest rates remains negative. Despite this, the MPC has decided to essentially end the cycle of interest rate hikes and has adopted a wait-and-see attitude. Policymakers prefer a gradual and slow decline in CPI to the target. In our view, such solutions mean that ultimately, the cost of fighting inflation will be higher.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap