Poland avoids recession but we see bumpy road ahead

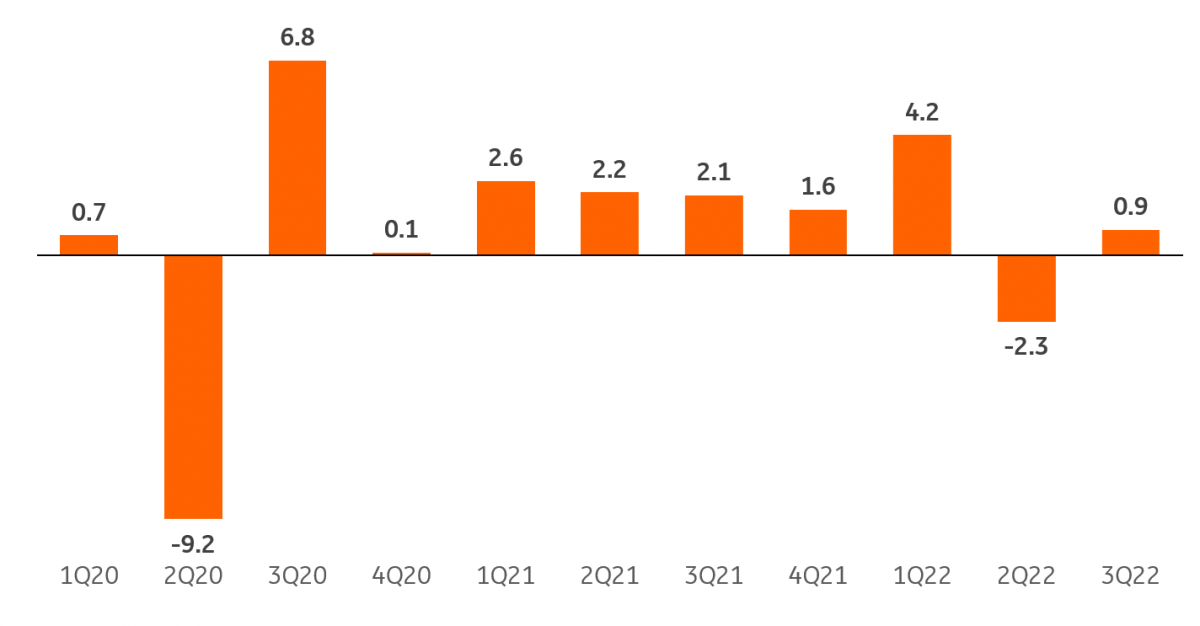

In line with our expectations, Poland’s economy expanded by 3.5% year-on-year in 3Q22 (consensus: 3.0% YoY) as activity bounced back by 0.9% quarter-on-quarter (seasonally adjusted) after falling by 2.3% QoQ in 2Q22. As such, Poland has avoided a technical recession but brace for some difficult months ahead

Technical recession averted so far

According to the flash estimate, GDP growth slowed to 3.5% YoY in 3Q22 from 5.8% YoY in 2Q22. The lower annual growth rate was a consequence of the high reference base from last year and the turnaround in the inventory cycle, which is no longer adding to GDP as it did in the first half of 2022. Seasonally-adjusted data shows that the outbreak of the war in Ukraine dampened economic activity in 2Q22 (GDP down 2.3% QoQ). However, 3Q22 saw a solid rebound (0.9% QoQ) and the economy avoided a technical recession.

Solid rebound in 3Q22 after sharp decline in 2Q22

GDP, QoQ (SA)

Industry and exports holding up well

We do not yet know the composition of economic growth (to be released on 30 November) but the high-frequency data suggests that industry continued to perform well. This is a very bright spot for the Polish economy and the main point of outperformance vs regional peers since the beginning of the pandemic. In 3Q22, manufacturing was supported by improvements in supply chains (including the availability of semiconductors), which boosted production in Poland and among our trading partners. The foreign trade balance most likely contributed positively to annual GDP growth, while consumption and investment had a markedly smaller positive impact as they grew much slower than in the previous two quarters. We estimate that growth in 2022 as a whole will be closer to 5% than 4% (around 4.8%), compared to 6.8% growth in 2021 (after revision).

Gloomy outlook for upcoming quarters

The prospects for the future look grim due to deteriorating foreign markets (a possible recession in Germany) and tighter financial conditions both in Poland and abroad (rising interest rates). In addition, high inflation bites into households' real disposable income as wage growth fails to keep pace with price increases. This is accompanied by unfavourable consumer sentiment, which translates into reduced spending on durable goods. Weakening foreign demand and rising financing costs will also have a negative impact on investment activity. An additional source of uncertainly is the stalemate between Warsaw and Brussels on the Recovery Fund, which may hamper public investment.

MPC refrains from further hikes amid fears of a sharp economic slowdown

The high reference base from 1H22 means that we may witness a negative annual GDP reading in early 2023. In 2023, we forecast economic growth at 1.5% but the risks are clearly tilted to the downside. The negative economic outlook for next year is one of the main reasons why the MPC has decided to pause, and de facto end the interest rate hike cycle. The MPC is choosing this strategy despite the prolonged period of elevated inflation and the risk of it becoming entrenched at high levels in the coming quarters.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap