Philippines: Trade figures boosted by favorable base

March trade data shows sharp rise in exports and imports due largely to base effects

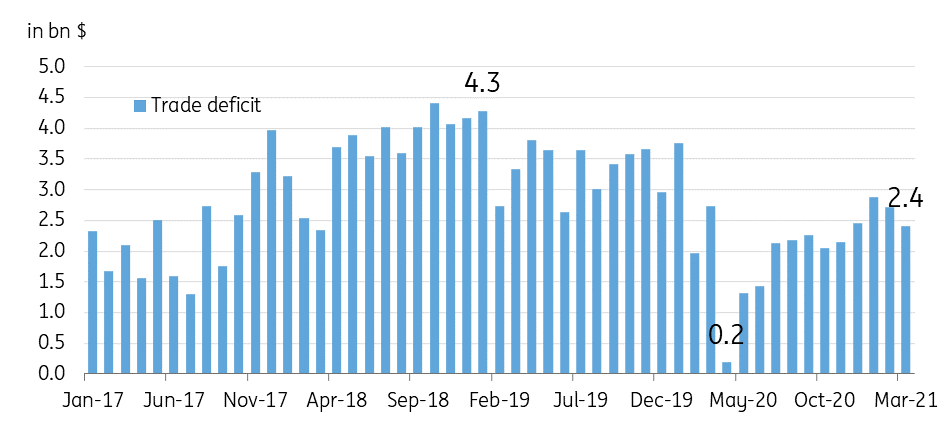

| $2.4 bn |

Philippine trade deficit |

| Better than expected | |

Exports surge 31.6% while imports jump 16.6%

March trade figures showed sharp gains for both exports and imports due in large part to base effects. Exports were up 31.6% partly due to base effects but also after a strong showing for the mainstay electronics subsector which posted a solid 25% increase compared to the same period in 2020. Demand for electronics and subcomponents will likely remain high given the global chip shortage - a development that could bode well for this sector in the coming months. Meanwhile, imports rose 16.6% with all subsectors posting double-digit gains. However, we believe the import rise was driven largely by base effects with the Philippines placed under hard lockdowns in March of last year. Despite the sharp swings for both exports and imports, the overall trade deficit stayed modest at $2.4bn, which should translate to a current account surplus for the Philippines, lending support to the PHP.

Philippine trade deficit

Trade trends to hold in coming months

We expect the base effect induced expansion for both exports and imports to continue in the coming months with the Philippine economy relatively more open in 2021 compared to last year. Demand for electronic components given the global chip shortage may also help lift demand for the export sector. Despite these trends, we expect the trade deficit to remain relatively manageable at around $2.5bn as corporate demand for the dollar is weighed down by dimming growth prospects onshore with partial lockdown measures still in place more than a year into the pandemic. The slightly narrower trade deficit will translate into a modest current account surplus which should be supportive of PHP in the near term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap