Philippines: Remittances post another month of unexpected growth in October

Overseas Filipino (OF) remittances posted another month of unexpected growth, with OFs finding a way to send home funds despite the challenges posed by the pandemic.

| 2.9% |

October remittance growth |

| Better than expected | |

October remittances rise 2.9%

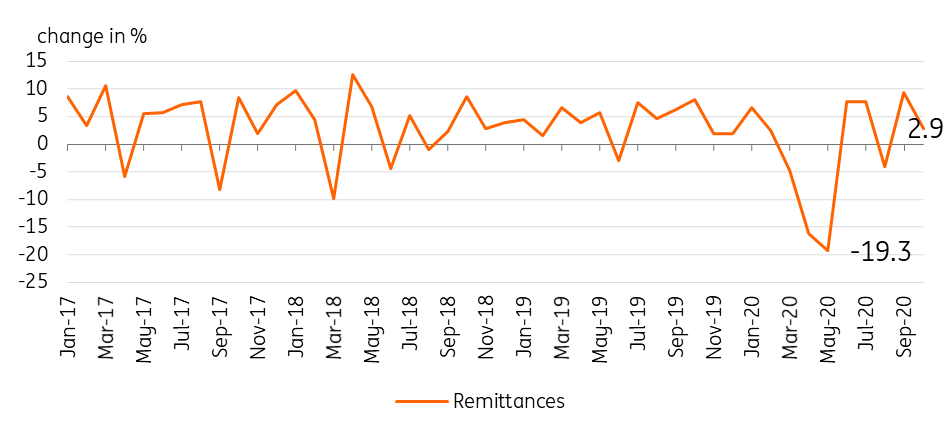

October remittances totalled $2.74 bn, up from $2.6 bn in September and also increasing from the amount sent home in October 2019. The two month pickup is welcome as remittances augment weaker domestic incomes, with the Philippine economy in full recession. Meanwhile, the slower pace in remittance flows compared to the previous month (+9.3%) may reflect the impact of renewed lockdowns imposed by authorities in host nations as Covid-19 infections spiked globally during the period. Remittances are weaker by 0.9% for the first 10 months of the year, totaling $24.6 bn and on track to beat the Bangko Sentral ng Pilipinas’ (BSP) forecast for a 2% contraction.

Philippine Overseas Filipino remittances

Surprise remittance growth possibly tied to PHP strength

At the start of the pandemic, most analysts had expected a severe contraction in migrant flows as the pandemic forced lockdowns in host countries, crippling economic activity on a global scale. Remittance flows contracted by 19.3% in May but have since stabilized, posting growth for 4 out of the last 5 months. Remittances managed to expand despite the repatriation of more than 300,000 OFs who were sent home after job losses in their host countries. The surprising resilience of remittances in the face of the pandemic may be traced to the appreciation trend of PHP, which is currently stronger by 5.5%. Funding the Philippine domestic consumption needs of their families, OFs may have been forced to compensate for the dollar’s relative weakness against PHP by sending home more remittances in dollar terms.

For the balance of the year, we can expect remittance flows to show only modest growth with lockdowns reinstated across the globe in response to the latest spike in Covid-19 infections. The sustained strength of PHP will put pressure on OFs to send home more dollars but physical restrictions and work stoppages may make limit the potential rise in remittance flows in November and December. The surprise expansion for remittances flows supports our expectation for short term peso appreciation and the sustained inflows may also help bolster consumption momentum to close out 2020.