Philippines: Inflation to close 2018 below 6%

Index heavyweights food and energy items to pull inflation lower, with the December print seen at 5.5%.

| 5.5% |

ING forecast for December inflation |

Finally below 6%

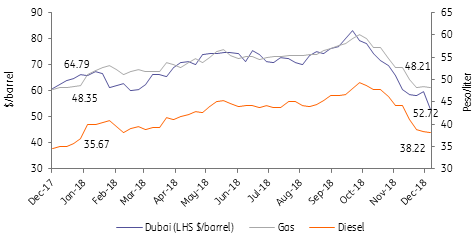

Index heavyweights food items and energy-related sub-indices are seen to have pulled inflation below the 6% handle as supply chains normalize and global energy prices plunged faster in November and December than they rose from September to the 2018 peak in October. The 4Q harvest season and imports of grains have helped stabilize supply (and price) for most food items, with the latest government bulletin showing second week of December rice inflation at 10.03% down from November 2018’s 14.46%. Meanwhile, domestic pump prices have tracked the freefall seen in Dubai oil prices, with gasoline prices now below pre-2018 tax reform levels and with diesel not far behind. The November-December plunge led to transport fare adjustments being rolled back, although the government has decided to proceed with the second tranche of its excise tax adjustment to fuel (both gasoline and diesel) of P2.00 for 2019.

Philippine pump prices and Dubai crude prices

Supply side inflation

2018 inflation moved well past BSP’s inflation target as a confluence of bad weather, disrupted supply chains, currency depreciation and tax reform fomented cost-push inflation. With these supply-side oriented bottlenecks mitigated or removed, we can expect inflation pressures to dissipate quickly and the overall headline print to slide in 2019, barring any return of these supply issues. Should inflation continue to trend lower and move within target as early as 2Q19, the BSP could move to unwind some of its aggressive hike cycle to help buttress forecasted slower GDP growth for the year. Cuts to the BSP’s policy rate are expected to be carried out even with the central bank widely expected to slash reserve requirements (RRR) as early as 1Q19.

Risks to the inflation outlook appear tilted to the downside

With the rice tarrification law all-but waiting President Duterte’s signature and oil prices sliding to levels last seen in mid-2017, risks to the inflation outlook appear now more tilted to the downside although upward pressure looms with possible extreme weather conditions with El Niño forecasted in the first half of 2019. Surprise OPEC supply cuts could cause crude oil’s recent plunge to reverse.

Download

Download snap

3 January 2019

Good MornING Asia - 3 January 2019 This bundle contains {bundle_entries}{/bundle_entries} articles