Philippines: Inflation decelerates to 2.6%, BSP to carry on with easing cycle

With price pressures fading quickly, BSP gains scope for further action

| 2.6% |

February CPI inflation |

| Lower than expected | |

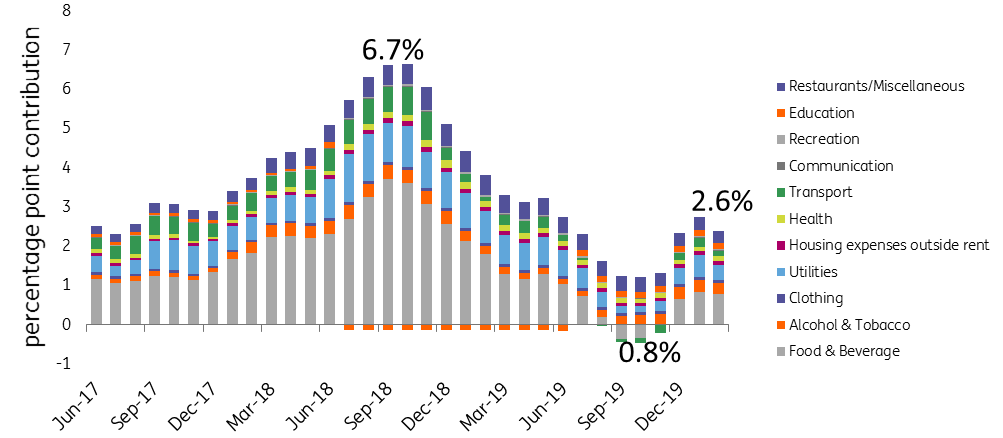

February inflation slows to 2.6% from 2.9%

Price pressures abated in February as global crude oil prices plunged, dragging on transport costs and utilities. Global crude oil prices tanked to as low as $44/barrel in late February as the Covid-19 virus shut down China, prompting a possible production cut from OPEC members. Lower crude oil prices forced transport costs and utilities to post deflation of 1.0% and 0.1% on a month-on-month basis and helped the headline print settle lower. Food inflation was also subdued despite increases in fish, other meat and vegetable prices as rice inflation proved favorable despite the increase in imported grains.

Philippine inflation, percentage point contribution per component

Benign inflation outlook affords BSP scope to ease policy rates

BSP forecasts inflation to settle at 3.0% for 2020 and 2.9% in 2021 and the February inflation print points to inflation settling close to that number. With the price objective still within reach and with the global economy projected to hit a severe downturn in the face of Covid-19, we expect Bangko Sentral ng Pilipinas (BSP) to continue its easing cycle in the near term. Governor Diokno had previously pledged a 25 bps policy cut in 1H. The BSP Governor ruled out resorting to an emergency policy meeting to cut rates immediately.

We think that Diokno will hold off on rate cuts until the May meeting as he awaits 1Q GDP data, pointing to his “pre-emptive” rate cut in February as sufficient action for the time being. Moreover, as he has also indicated, "fiscal policy would be more effective at this point". With inflation likely held in check until mid-year and with 1Q GDP likely to disappoint, we expect him to deliver his 25 bps policy cut at the May meeting.

Diokno may then assess if further rate action is needed while reducing reserve requirement (RR) ratios in 2H should bank-lending pick up substantially in the coming months. With expectations for further rate cuts by the BSP in the near term, we expect bond yields to be pressured lower and the Peso to weaken with investors looking to comments from BSP Diokno for further guidance.

Download

Download snap

6 March 2020

Good MornING Asia - 6 March 2020 This bundle contains {bundle_entries}{/bundle_entries} articles