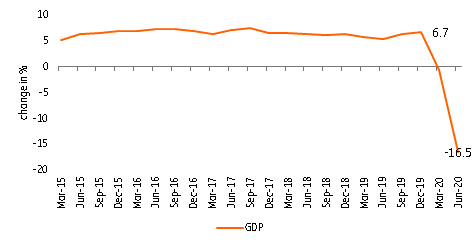

Philippines: Economy crashes into recession, down 16.5%

Enhanced quarantine community lockdown measures knocked out household consumption with the economy shrinking 16.5% in the second quarter, the steepest drop on record

| -16.5% |

2Q GDPsteepest contraction on record |

| Worse than expected | |

Lockdown knockdown

2Q GDP cratered by 16.5% with strict lockdown measures shackling once-promising growth momentum. With mobility curbed, household consumption shrunk 15.5% as Filipinos were forced to shelter in place to limit the spread of the virus. Capital formation also went into freefall with construction down 32.9% and investment in durable equipment plunging 62.1% as investor sentiment evaporated amidst the pandemic and 17.7% unemployment. Offsetting the contraction somewhat was growth posted for net trade and government spending (+22.1%).

Philippines GDP

Crash landed, dirty-L recovery now more likely

The Philippine economy crash-landed into recession with the 2Q GDP meltdown showcasing the destructive impact of lockdowns on the consumption-dependent economy. With record-high unemployment expected to climb in the coming months, we do not expect a quick turnaround in consumption behaviour, all the more with Covid-19 cases still on the rise. With consumption dropping by 15.5%, investor sentiment will likely go into freefall with the recent investment boom snuffed out by the pandemic.

The BSP may be running out of ammunition

Government spending rose 22.1% and will be counted on to offset the steep decline in economic activity over the next few quarters. Finance Secretary Dominguez has placed his bet on infrastructure via the flagship Build-Build-Build programme, which could help revive construction activity to some extent. However, given that household spending is expected to be sidelined for the foreseeable future due to a fractured labour market and a downturn in remittances, the Philippine economy is likely headed for a base effect-induced bounce in 2021 and a return to the lower 3.5-4.5% growth trajectory of yesteryear by 2022.

Bangko Sentral ng Pilipinas (BSP) Governor Diokno may be pressured to cut policy rates again to help shore up growth momentum but given that real policy rates are now negative (-0.45%), the BSP may be running out of ammunition with fiscal stimulus likely called upon to help slow the downturn.

Download

Download snap

7 August 2020

Good MornING Asia - 7 August 2020 This bundle contains {bundle_entries}{/bundle_entries} articles