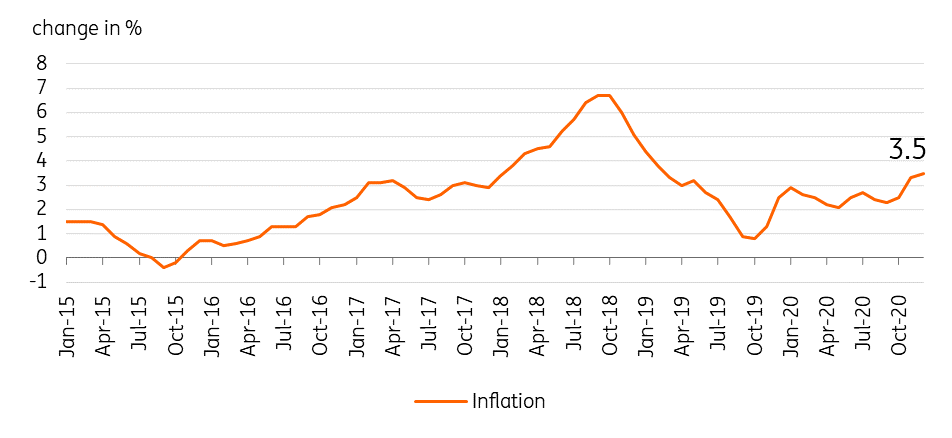

Philippines: December inflation peaks at 3.5% as food inflation persists after recent spate of typhoons

Headline inflation remains elevated as food inflation persists after recent spate of typhoons

| 3.5% |

December CPI inflation |

| Higher than expected | |

Sticky downward

December inflation accelerated to 3.5%, the fastest pace since March 2019, as price pressures emanating from the index-heavy food basket drove headline inflation higher. Market analysts had predicted December inflation to settle at 3.2%, ING forecast inflation to rise to 3.4%. Recent storm damage to agricultural production forced prices for select vegetable to rise significantly, with food inflation accelerating to 4.8% (from 4.3% previously). The disruption and destruction from the string of typhoons was enough to keep food prices elevated while food supply chains are restored. Transport costs also exerted upward pressure on the headline figure with higher fuel prices and expenses related to minimum health standards for transport resulting in an inflation rate of 8.3% for the sector. Meanwhile, offsetting the upward pressure from food and transport, deflation was noted in recreation and culture (-0.6%) given the ongoing recession.

Philippines inflation

Not so transitory

Bangko Sentral ng Pilipinas (BSP) Governor Diokno indicated that the recent spike in prices would be transitory and that the central bank would aim to keep its policy stance accommodative given the ongoing pandemic. With the recent inflation reading, real policy rates are now -1.5% with BSP not likely to cut policy rates any time soon. With the central bank pushing up its 2021 inflation forecast to 3.2%, we do not expect BSP to adjust its main policy rate soon. Diokno did hint at a possible reduction to reserve requirements (RR) in the near term. We forecast inflation to remain at 3.0% for 1Q 2021 with BSP likely keeping policy rates unchanged and Diokno possibly utilizing his provisional 200 bps reduction in RR by 1Q should 4Q 2020 GDP disappoint.

Download

Download snap