Philippines: 2Q GDP disappoints as revenge-spending fades and rate hikes finally weigh on momentum

2Q23 GDP grew 4.3%YoY, much slower than the market expectation of a 6% gain.

| 4.3% |

YoY growthslowest pace of expansion since 2011 |

| Lower than expected | |

2Q23 GDP disappoints in a big way

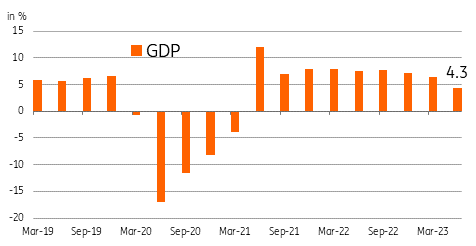

The Philippine economy grew 4.3%YoY in the second quarter of 2023, much slower than the market expectation, which was for a 6% gain. On a quarter-on-quarter basis, the economy contracted by 0.9% as high inflation and the lagged impact of previous monetary tightening weighed on economic activity.

This was the slowest pace of expansion since 2011, with growth momentum slowing due to a challenging global landscape, price pressures, lacklustre fiscal stimulus and elevated borrowing costs.

Overall, this was a disappointing report with the slowdown evident in all major sectors of the economy. Household consumption posted slower growth of 5.5%YoY, slowing from the 6.4% expansion in 1Q23. A combination of fading revenge-spending on top of an unfavourable base effect (presidential elections were held in 2Q 2022) capped household consumption.

Meanwhile, the aggressive tightening carried out by Bangko Sentral ng Pilipinas last year weighed on capital formation, with overall investment outlays unchanged from last year.

Lastly, government spending, which had been an important source of support throughout the pandemic, contracted by 7.1%YoY. Year-to-date growth slowed to 5.3%, much lower than the government’s target of 6-7% growth, which now looks out of reach given our expectation for growth to slow further in the coming quarters.

PHL economic growth sputters to slowest pace (YoY%) since 2011

Governor Remolona stuck between slowing growth and rising inflation risk

BSP meets next week to discuss monetary policy against a backdrop of slowing domestic growth momentum and rising upside risks to the inflation outlook. The Philippines imports energy and grain, and the prices of both have been on the rise recently, potentially threatening the current downward path of inflation.

BSP Governor Remolona has indicated that any policy decision will remain data-dependent and today’s disappointing GDP report will likely figure in next week’s decision.

We believe Governor Remolona will need to consider a pause to provide growth with some support while remaining hawkish in his statement by vowing to hike if upside risks to the inflation outlook materialize.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap