People’s Bank of China surprised markets with a 25bp cut to the five-year loan prime rate

The People's Bank of China kept the one-year loan prime rate (LPR) unchanged at 3.45% as expected, but surprisingly cut the five-year LPR by 25bp to 3.95%, the first time the five-year rate was cut since May 2023

| 25 |

bp rate cut to the 5-year LPR |

| Higher than expected | |

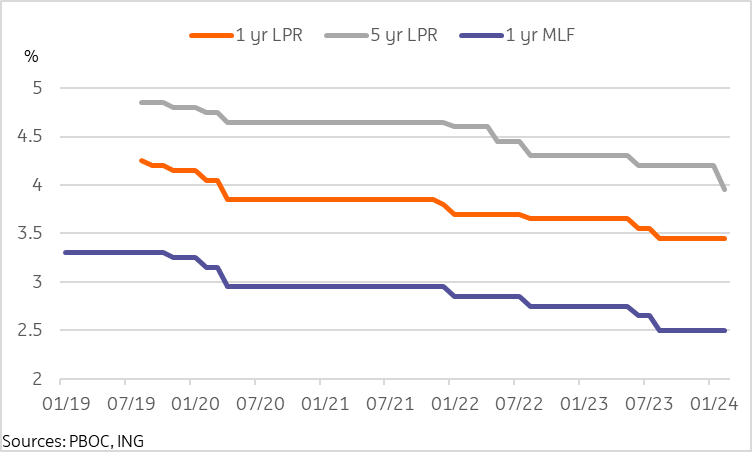

China key interest rates

Five-year LPR cut may be targeting property market recovery

As anticipated, the PBoC kept the 1-year LPR unchanged at 3.45%, mirroring the unchanged Medium-Term Lending Facility decision from the weekend. We believed this key policy rate would likely be kept unchanged in February's decision, as policymakers conserved limited ammunition ahead of a possible broader policy push in the next few months. Given the RMB depreciation pressure amid unfavourable interest rate spreads, we saw limited room for manoeuvre before global central banks shifted toward rate cuts.

However, in a surprise move, the PBoC cut the 5-year LPR was cut by 25bp to 3.95%. While single-sided LPR cuts have occured in the past, it was always the 1-year rate that was cut while the 5-year rate was maintained. The main justification for this in the past was to preserve banks' net interest margins, as the 5-year LPR is used as the reference rate for mortgages. The February decision was the first time since the LPR came into use in 2019 that the PBOC cut the 5-year LPR while keeping the 1-year LPR unchanged. The 25bp cut was also the largest cut to the 5-year LPR on record.

The cut to the 5-year LPR is likely aimed at supporting the recovery of the property market, and could improve affordability for buyers by lowering the mortgage rates. However, banks were already facing record low net interest margins as of the third quarter of 2023, and have been tasked with extending loans to support troubled property developers. The 5-year LPR cut could add further pressure to Chinese bank margins.

Chinese banks' net interest margins have been under pressure

PBoC is likely to remain on a dovish tilt in coming months

With inflation low and economic momentum still tepid in early 2024, we believe that monetary policy will remain accommodative in China moving forward. We still see room for one more cut to the key 1-year LPR in near term, and a further reserve ratio requirement cut is possible as well. If global central banks do begin rate cuts later in the year, that will likely free up more room for the PBoC to ease policy further.

Download

Download snap