PBOC held rates steady in March

The PBOC held the 1-year medium-term lending facility (MLF) rate at 2.5% in March. The PBOC remains on a dovish tilt, but depreciation pressure on the RMB limits room for monetary easing in China before global central banks start to cut rates. The PBOC will likely time its rate cuts carefully to support a broader supportive policy push in the upcoming months

| 2.5% |

1 year medium-term lending facility rateUnchanged from February |

| As expected | |

PBOC stood pat in March

The People’s Bank of China (PBOC) kept the 1-year Medium-term Lending Facility (MLF) rate unchanged at 2.5%, in line with expectations. Typically the MLF decision is a precursor for the Loan Prime Rate (LPR) decision to follow. Last month proved an exception as we saw the 5-year rate cut while the 1-year rate was left unchanged, the first time on record we saw an asymmetric rate cut where the 5-year rate was cut instead of the 1-year rate.

This month, we expect a return to normal, where the unchanged MLF will signal no movement in the LPR as well.

China key interest rates

Stability of the RMB may restrict monetary policy in 1H24

After the language on monetary policy and the RMB was unaltered during the Two Sessions, we expect there is limited room for PBOC policy easing before global central banks start to cut rates, as RMB stability remains a policy objective and further widening the interest rate spread with a rate cut would add to depreciation pressure, especially given developments abroad have generally trended in a more hawkish than expected direction in early 2024.

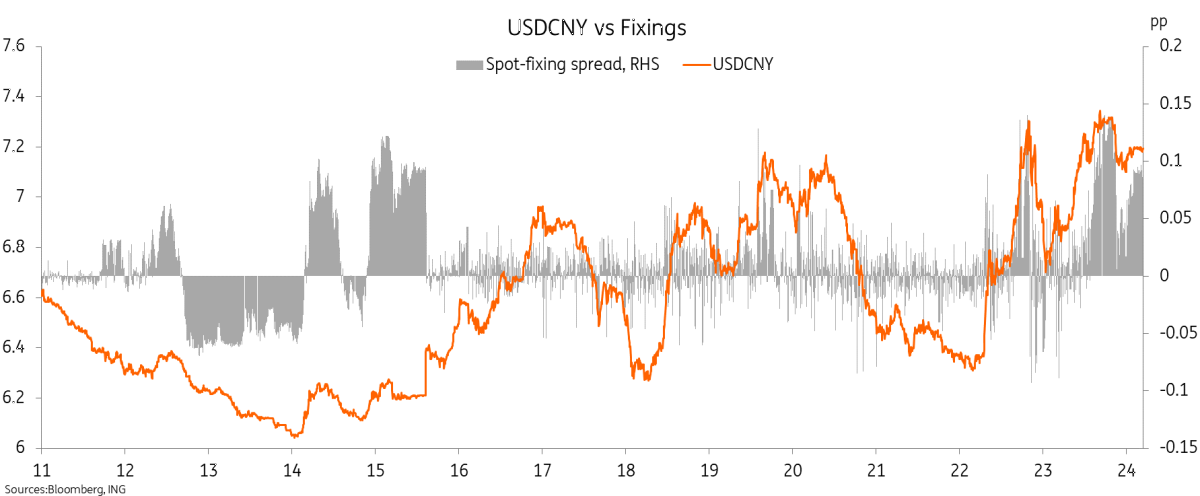

While the USDCNY rate has been mostly stable around 7.20 over the past month, this is in large part due to the PBOC, which has already started to push back more against RMB depreciation in the first few months of 2024 by applying the counter-cyclical factor to its daily fixings. The degree to which the PBOC is pushing back against RMB depreciation is not yet near the peak levels of 2023 but has gradually risen since the start of the year.

PBOC has pushed back more against RMB depreciation since the start of the year

PBOC to remain on a dovish tilt

The last cut to the 1-year MLF was in August 2023, and while there appears to be a consensus that rates will eventually be cut further, market views have been split on the timing for this cut.

With limited room to manoeuvre in the short term, we expect one more MLF and LPR cut in the coming months to support a broader stimulus policy push. However, after PBOC governor, Pan Gongsheng, hinted at more room for RRR cuts ahead, we may see an RRR cut before the next MLF and LPR cut. Credit data released later today will show how effective the first RRR cut was in stimulating lending.

Our view is that a rate cut will be more effective in supporting the economy compared to a further RRR cut, and given that we are likely to see a more challenging road to achieving the 5% 2024 GDP growth target this year, monetary policy easing will likely have to be a part of efforts to reach this goal.

Download

Download snap