No slowdown in sight for US consumer spending

US consumer confidence remains close to all-time highs as households feel the benefits of huge tax cuts, a strong jobs market and rising asset prices

The Conference Board measure of US consumer confidence rose to 127.4 in July from June’s upward revised 127.1, led by a decent rise in the current conditions component (165.9 from 161.7). The expectations component, which has historically been a good guide for consumer spending slipped a little but even so, it’s rarely been higher in the survey’s 51-year history.

Jobs are key

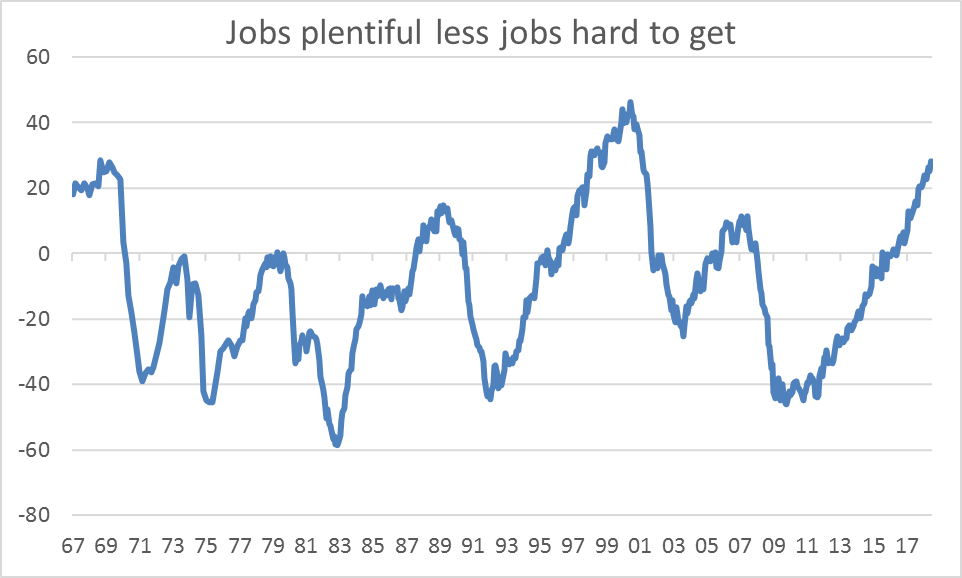

Consumer sentiment is clearly being buoyed by the $1.5 trillion of tax cuts, which is putting more cash in peoples’ pockets and a strong jobs market. Household feel very secure in their employment with the key barometer within the report– “jobs plentiful” less the “jobs hard to get” index at a 17-year high. Households also feel very confident about job prospects over the coming six months so it is no surprise to see the survey details showing a huge appetite to continue buying big-ticket items such as cars and homes.

Rising asset prices are also a big support for consumer sentiment with US house prices rising 6.5%YoY according to today’s Case Schiller price index while equity markets remain close to all-time highs. Interestingly, the report implies that households don’t feel unduly concerned by trade protectionism and trade wars and suggests that the strength in consumer spending will continue right through 3Q18.

We continue to forecast GDP growth of around 3%QoQ annualised for 3Q18 and expect full-year 2018 annual growth to also be 3%. In an environment where inflation is rising and wage pressures are more likely to grow than fade, we feel that the Federal Reserve will raise interest rates at least twice more this year. In fact, tomorrow’s FOMC statement could well strike a bolder tone given little evidence of any loss of economic momentum from the rate hikes implemented so far.