Nickel: Beware the Chinese speculator

A 22% surge in Shanghai Futures Exchange positions drove nickel prices up 5.5% on Wednesday. Profit taking is a risk

SHFE Nickel positions jump 22% on speculative buying

The power of SHFE

Shanghai’s speculative flows have been an increasing presence in the market since 2015 when both the collapse and eventual halting of the stock market drove retail traders to metals. The growth of the SHFE Nickel contract has been just awesome with volumes at times matching the 39-year-old LME contract and all this after only having launched in March 2015.

SHFE Nickel almost matching LME

SHFE and LME Nickel Volumes (Mt)

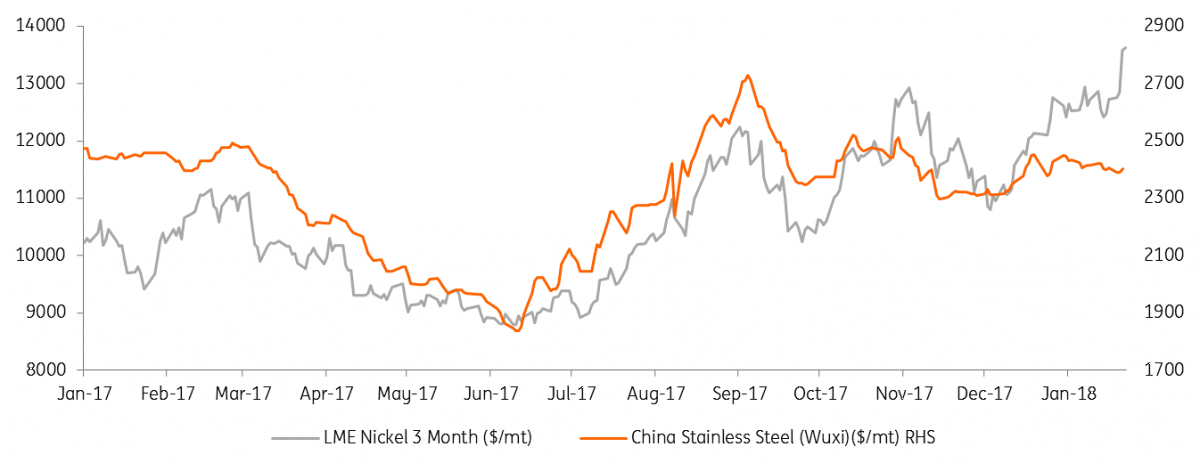

Nickel vs Stainless could be cause for concern

Given the highly speculative and even retail trading base of SHFE, a quick turn to profit taking and mass liquidation is always a risk. On a fundamental basis, we do feel cautious. We note that stainless steel prices almost perfectly led the nickel price through 2017. Even following the EV hype that followed LME Week in November, once nickel overshot the price of this core demand unit the market soon reversed. Nickel's outperformance of stainless had put it on our watch list back in December and if yesterday’s price gains don’t follow through, then it will seem the demand side of the equation isn’t matching up. Stainless steel is responsible for c.60-70% of nickel demand with EV and batteries still making up less than 5%.

ING expects Nickel prices to average $11,000/mt in 2018 and whilst we do see supply deficits we think that high inventory will keep prices capped. We are expecting prices to rise to $13,000 through 2020 as those stocks are drawn down.

Stainless will need to reflect rising nickel prices

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap