Malaysian central bank starts policy normalisation

We forecast one more 25bp rate hike from Bank Negara Malaysia in the third quarter, after political uncertainty lifts

| 3.25% |

BNM policy rate

|

| As expected | |

BNM raises rates by 25bp

Bank Negara Malaysia (BNM), the central bank raised the overnight policy rate by 25bp to 3.25% today, the first policy move since July 2016 when BNM had eased by 25bp. The hike was well-flagged by BNM at the previous policy meeting in November, widely predicted by 16 out of 20 forecasters in the Bloomberg poll, and priced in by the markets as evident from accelerated Malaysian ringgit appreciation since early November. Therefore, we expect little to no market impact from the rate hike.

Normalisation, not tightening

As the BNM policy statement notes, this is a normalisation of monetary policy, not a tightening. The statement highlighted, “… the need to pre-emptively ensure that the stance of monetary policy is appropriate to prevent the build-up of risks that could arise from interest rates being too low for a prolonged period of time”.

The policy space

Today’s BNM move takes the policy rate to the level where the post-2008 Global Financial Crisis tightening cycle had left it at. With the policy rate likely hitting the historical (since BNM implemented new interest rate framework on 26 April 2004) peak of 3.50% within the current year, we do not anticipate the current tightening cycle to stretch for too long.

We forecast one more 25bp BNM rate hike in the third quarter, after the political uncertainty associated with general elections in August lifts. At the moment we see no strong reasons for the BNM to tighten policy too much. The economy remains on a firm footing to eke out a 5%-plus growth for another year in 2018. Rising global commodity prices should support exports as election spending works its way to boost strong domestic demand. Absent a supply shock to food prices or an oil shock to fuel prices, the inflation outlook for this year appears to be benign.

Against such an economic backdrop, the relative undervaluation offers the Malaysian Ringgit sufficient scope to outperform Asian peers again in 2018. We are reviewing our end-2018 USD/MYR forecast of 3.78% for downward revision.

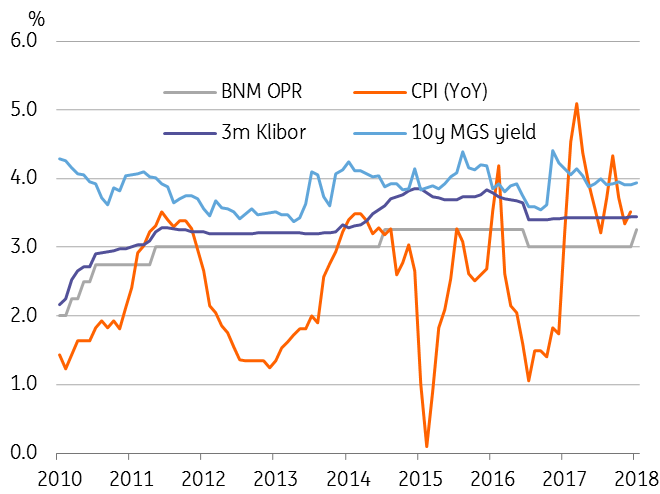

Inflation, BNM policy and market rates

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

25 January 2018

Good MornING Asia - 26 January 2018 This bundle contains 2 Articles