Mixed US data offers little clarity on prospect of July Fed rate hike

The Federal Reserve’s hawkish hold yesterday suggests an inclination to hike again in July, but today's mixed retail sales and manufacturing data fail to offer a clear steer. The grinding higher in jobless claims is perhaps the bigger story, but it probably won’t be enough to lead to a sizeable slowdown in payrolls growth to deter the Fed just yet

Retail sales led by autos and building materials

Today's US numbers are a bit mixed and do little to provide clarity on the outlook for interest rates. Retail sales were better than hoped, rising 0.3% month-on-month versus the -0.2% consensus yet the control group (which strips out volatile components and better matches with broader consumer spending trends) came in at +0.2% as expected while there was a downward revision to April from (+0.7% to +0.6%).

The details show building material sales surged 2.2% MoM while motor vehicle and parts sales jumped 1.4% despite the unit auto sales from manufacturers reporting a sizeable contraction (down to an annualised 15.05mn from 15.91mn) and the CPI suggesting prices for new vehicles fell 0.1% MoM. Strip out these two components and retail sales would have fallen 0.5% on a 3M annualised rate. The underlying story is weaker than the headline suggests.

Retail sales levels

Jobless claims suggest a softening jobs market

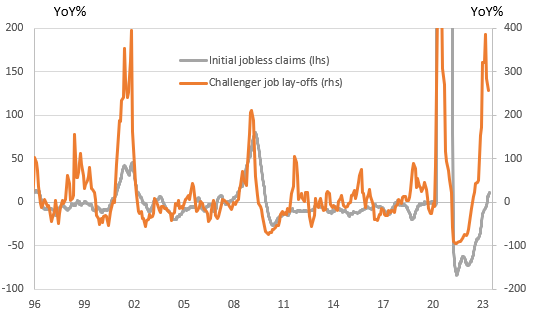

Arguably the bigger story is the initial jobless claims numbers. Remember, they surprisingly jumped last week to 261k from 233k. The market had been expecting a retracement back to 245k, but instead, they were revised up last month by 1k and have held at 262k this week. Continuing claims have also moved higher to 1.775mn from 1.755mn (consensus was 1.768mn). This means we have the highest number of initial jobless claims since October 2021 with the job lay-off announcements pointing to jobless claims continuing to grind higher in the coming weeks and months. Consequently, while demand for workers remains firm, the rising lay-offs mean we should anticipate the net gain in payrolls to moderate. Furthermore, there is a concern that we are losing well-paid, full-time jobs in the likes of the tech and business service sectors, and they are merely being replaced by lower-paid, part-time jobs in the leisure and hospitality sectors.

Rising lay-offs suggest jobless claims have further to rise (%YoY%)

Manufacturing is weak outside of autos

Meanwhile, May industrial production fell 0.2% MoM versus the +0.1% consensus. Manufacturing actually rose 0.1% rather than contract 0.1% as the consensus predicted, but mining fell 0.4% while utilities output fell 1.8% on reduced electricity consumption. Within manufacturing, auto output rose 0.2% MoM to stand 10% YoY higher given strong order books, but all other components are softer with total manufacturing output down 0.3% YoY and ex-auto manufacturing down 1.1% YoY. The regional manufacturing indicators - the very volatile NY Empire survey and the Philly Fed survey - moved in different directions with the Empire survey strengthening significantly while the Philly Fed softened. The national ISM index has been sub-50 (in contraction territory) for seven consecutive months and these regional indicators suggest we should expect this to continue for an eighth month.

Industrial production levels

Other numbers include import prices falling a little more than expected (-0.6% MoM/-5.9%), underscoring the point made in yesterday's PPI report that pipeline price pressures are weakening swiftly even though the Fed doesn't want to acknowledge it.

Download

Download snap