Malaysia: Trade surplus hits all-time high in October

As elsewhere in Asia, the worst of Malaysia’s trade downturn appears to be over though the recovery could be painfully slow

| 17.3bn |

October surplus (MYR)Highest ever |

| Higher than expected | |

Record trade surplus is positive for Malaysian ringgit

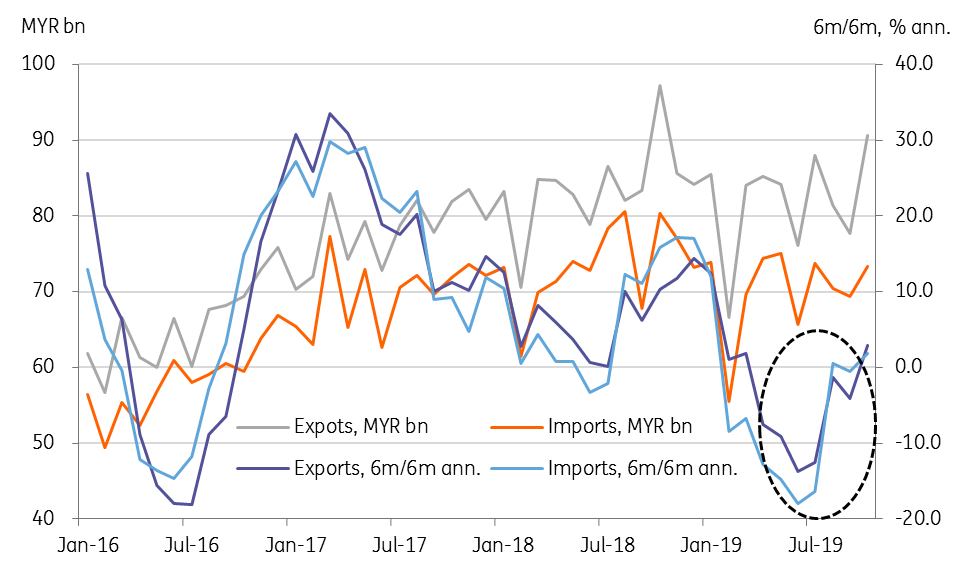

Firmer exports swelled the trade surplus to a record MYR17.3 billion in October from MYR8.4 billion in the previous month (consensus MYR11 billion). This takes the year-to-date surplus to MYR118 billion, or MYR14 billion wider than a year ago. The higher trade surplus means a higher current account surplus, which we see rising to about 2.3% of GDP this year from 2.1% in 2018.

The external payments situation remains supportive of the Malaysian ringgit (MYR), one of Asia’s most resilient currencies to the global trade contagion so far. We see the USD/MYR hovering around the 4.18 current spot level through the rest of the year.

Exports fall but not as much as expected

Exports contracted for the third straight month in October by 6.7% year-on-year. However, the pace of contraction was unchanged from September, which was a surprise to the markets which expected a much deeper, 12% plunge. Electrical and electronics exports were the obvious source of surprise (-3.2% YoY vs. -12.2% in September), offsetting accelerated weakness in commodities exports (oil and petroleum products, metals, rubber, etc.).

Imports swung to a fall of 8.7% YoY in October from 2.4% growth in the previous month. The decline was slightly steeper than the -7.0% consensus view.

The worse seems to be over

October is also a seasonally strong month for trade with big month-on-month bounces in both exports and imports, 16.6% and 5.6%, respectively this year. This may have made this a better set of numbers, absent which the high base effect would have significantly dented growth.

Still, despite the seasonal fluctuations, the underlying trend seems to be improving for exports, and also for imports given the high import content of exports. That said, resurgent US-China trade tension bodes ill for the near-term recovery, which could be painfully slow.

Download

Download snap

5 December 2019

Good MornING Asia - 5 December 2019 This bundle contains {bundle_entries}{/bundle_entries} articles