Making US Steel Great Again

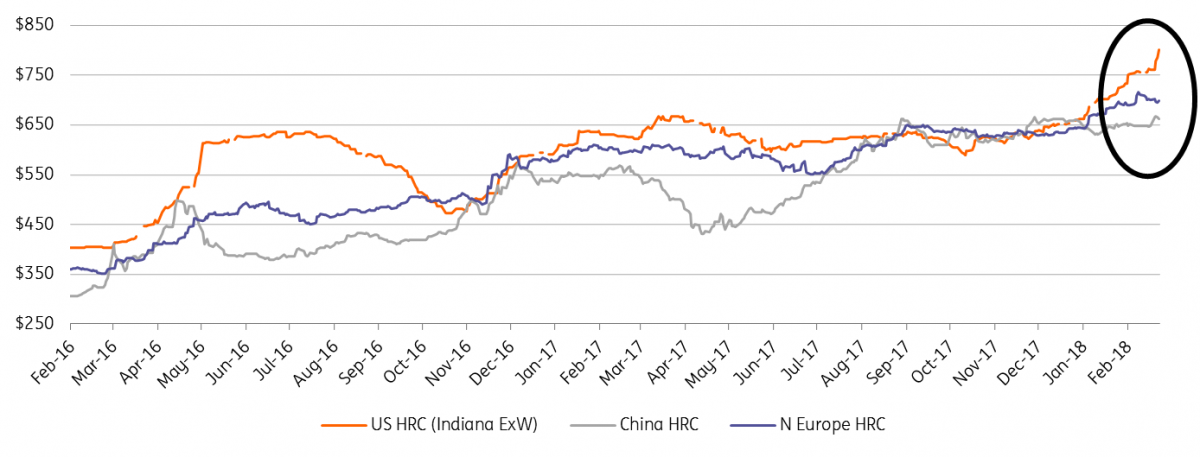

US hot-rolled coil prices have been trading $100/mt above Europe in anticipation of trade duties. President Trump's announced 25% tariff will affect 30% of US demand, a considerably lower portion than the tariff impact in aluminium. The impact on costs for the consumer will vary by product

Quick Take

In 2017, the US imported 34.5Mt of steel, making up 30% of consumption. As tariffs are imposed, a drop off in exports (9.5Mt) and a boost in domestic mill utilisation could easily see this import reliance drop to under 20%. The pricing effects on US consumers will, therefore, be considerably less than the 25% imposed and less severe than the story unravelling in aluminium. The effect does vary by steel product, however.

US HRC premium widens to Europe/China

Weighing up imports

The US currently imports around 30% of its steel consumption needs. This compares to over 80% for aluminium. But steel mill utilisation only averaged 74% last year (vs a commerce target of 80%) and exported 9MT. Cutting those exports and boosting utilisation to 80% reduces the import need to under 20%. At 90%, the figure is only 7% and this is even before we account for any new capacity builds. It is likely, therefore, that the incremental cost to be paid by US consumers will end up considerably below the 25% tariff. Import dependency does vary by product, however.

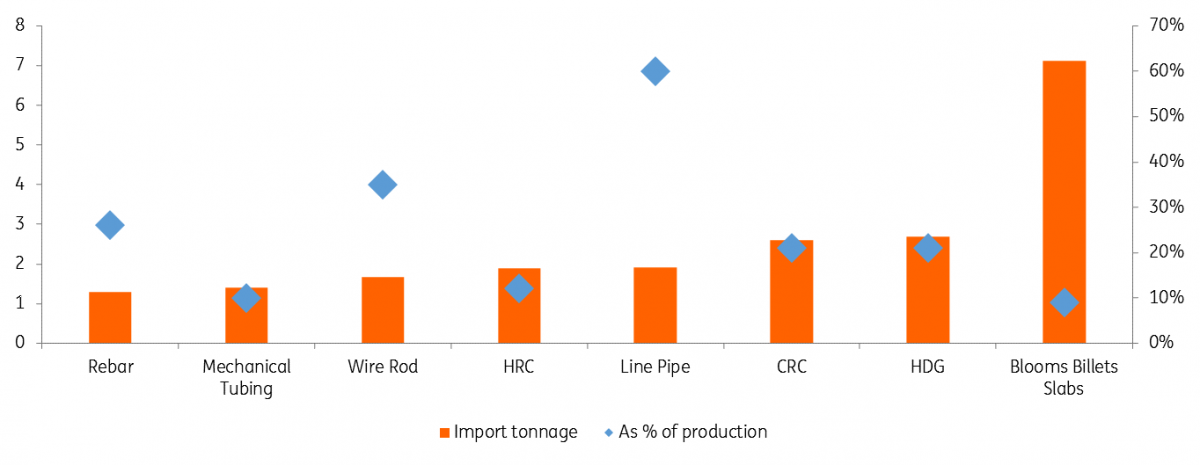

Of US imports, the largest tonnage is crude steel in semi-fabricated form: billets/blooms/slabs, this represents only 7% of the crude steel production and the quickest import void filled by higher utilisation of US mills. After this, the flat products (hot and cold rolled steel) do have the highest tonnage of imports but lower dependency. Long products: Rebar/Wire Rod look more at risk of higher local prices basis the import dependency but expansions of domestic supply should see this decrease. Line Pipe is an example of a lower tonnage but more exposed market with import dependency around 60%.

2017 US steel imports by product and import dependency (%)

Download

Download snap