Korean GDP pushes above pre-pandemic levels

Stronger than expected growth was led by business investment, though the consumer is no slouch either. The big unknown is, can Korea keep on top of its Covid-19 cases while its vaccination rollout struggles to get going - if it does, then 4% growth is achievable

| 1.6% |

GDP QoQ%Up from 1.2% in 4Q20 |

| Better than expected | |

Better than expected growth

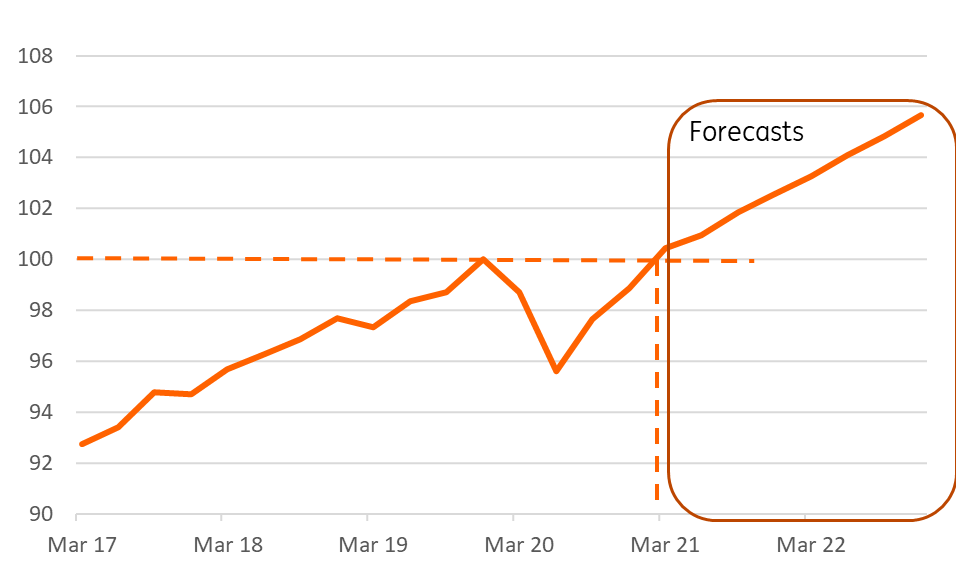

South Korea's GDP rose by 1.6% in 1Q21, stronger than the 1.1% expected, and up even from the solid 1.2% figures recorded for 4Q20 which was revised slightly higher from an initial 1.1% reading. That leaves GDP up 1.8%YoY, in other words, higher than a year ago, and also just higher than 4Q2019 pre-pandemic GDP levels too.

Korea's year-on-year gains will surge even higher next quarter as the comparison is boosted by base effects since 2Q20 marked the big quarterly decline in Korean GDP after the modest 1Q20 contraction (-3.2% fall in 2Q20 after a -1.3% decline in 1Q20).

Focussing as ever on the QoQ percentage gains (year on year measures at a time like this are really just reflecting 2020 weakness, not what is going on now), and the latest growth figures were dominated by very strong growth in business investment (+6.6%QoQ). This makes it look like the 1.1% consumer spending gains are off the pace, but annualised, this is more than a 4.5% rate, and really is not bad at all.

Korean GDP as an index (4Q2019 = 100)

Growth could top 4% this year

Doing nothing at all to our existing forecast profile for 2021, today's surprise numbers could take Korean GDP to within a whisker of 4% GDP growth for the full year. But there are clearly two-way risks to where this actually goes. The underlying momentum of the economy is obviously stronger than we had thought, with strength concentrated in the electronics sectors and supporting industries, but also broadening out to industries like autos. Export strength remains supported by regional, in particular Chinese strength, and this could also gain more support as countries like the US and regions like Europe see further economic growth as their economies re-open.

But closer to home, rising daily case numbers in Korea, albeit still only around the 700-750 mark currently, are a worry. We have seen repeatedly how rising cases at a low level can lead rapidly to an out-of-control situation (NB India), and Korea's vaccine rollout has been slow, even by comparison with other Asian countries. So before we push through the entire forecast update implied by today's figures, we may wait a month to see how the pandemic and vaccine rollouts progress. 3.5% is a good starting point for a 2021 GDP upgrade this month. We can see if there is room for a 4% forecast next month if the vaccination rate picks up and Covid cases remain moderate.

BoK to remain on the sidelines

With growth surging, talk of earlier Bank of Korea (BoK) tightening will inevitably pick up, and this could provide some further support to the Korean won (KRW) which appreciated today on the GDP data.

But at the moment, with Korean unemployment still above pre-pandemic levels, we believe that such talk is premature, and we still do not see the BoK tightening policy until the second half of next year. However, further gains in GDP like that seen today as well as further progress in the labour market could encourage us to consider an earlier 2022 move, especially given the backdrop of strong house-price growth and rising household debt ratios.

Download

Download snap

28 April 2021

Good MornING Asia - 28 April 2021 This bundle contains {bundle_entries}{/bundle_entries} articles