Korea: Headline inflation eased more than expected in August

Korea's headline inflation appears to have passed its peak but will likely stay above 5% for the rest of the year. The Bank of Korea will take some comfort from these latest inflation figures but will stay on a hiking path through to the year-end

| 5.7 |

CPI inflation%YoY |

| Lower than expected | |

Headline inflation eased more than expected but core inflation still rose in August

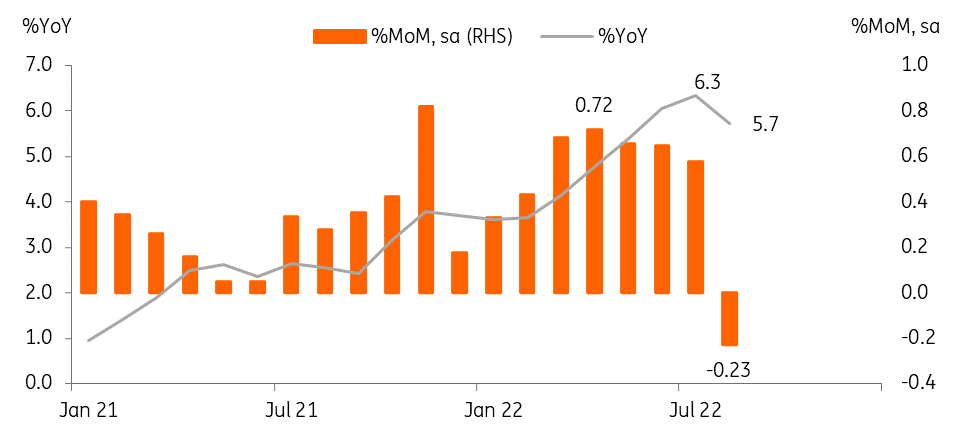

Headline inflation eased to 5.7% YoY in August (vs 6.3% in July), which was lower than the market consensus of 6.1%. But core inflation (excluding food and energy) continued to accelerate to 4.0% in August (vs 3.9% in July), showing that underlying price pressures remained strong. The unadjusted monthly growth rate declined by -0.1%, the first decline since November 2020. Extended fuel-tax cuts and a drop in gasoline prices was the main reason for the decline but fresh food and eating-out services rose firmly.

We think inflation has now passed its peak but it will likely remain above 5% for the rest of the year. Firstly, there is a high possibility that the price of fresh food will rise due to bad weather as SuperTyphoon Hinnamnor is expected to pass through the southern part of the Korean peninsula, a major agricultural area. Secondly, some staple manufactured foods, like instant noodles and bread are scheduled to rise after the Choseok holiday. Thirdly, utility fees such as city gas and electricity will rise again in October. Lastly, some local governments are also planning to increase service fees too.

Headline CPI slowed in August

The Bank of Korea is expected to raise rates 25 bp in October

The Bank of Korea (BoK) will continue to stay on a hiking path at least until the end of the year. Governor Rhee has made it clear that the BoK will continue to raise rates as long as inflation stays above 5% and growth conditions do not deteriorate meaningfully. We think these terms will remain in effect until the end of the year. However, as we get closer to the year-end, we will see clearer signs of a slowdown in growth, so the BoK could begin to give more weight to growth considerations in its policy decision. Today's weaker-than-expected inflation print supports our view that the BoK will end its hiking cycle at 3.0% in November.

Download

Download snap