Korea: From bad to worse

1Q19 GDP growth fell 0.3%QoQ. Another negative quarter in 2Q19 and therefore “technical recession” is quite plausible.

1Q19 GDP was bad

The biggest quarterly contraction in Korean GDP since the global financial crisis hit in 4Q 2008 has to be bad news. Year-on-year growth of 1.8% doesn't look too bad, but the components of GDP weakness don't bode well for the quarter ahead. It isn't hard to come up with a set of figures for 2Q19 that would deliver a further decline and as a result, a technical recession.

| -0.3%QoQ |

Korean GDP1Q19 |

| Worse than expected | |

How is 2Q19 shaping up?

It is early days to be calling the second quarter GDP estimates. For the most part. We don't even have any hard data for April yet. But GDP components tend to exhibit both trend persistence, mean reversion and negative cross-correlation and we can tweak some hypothetical figures to see how sensitive the current GDP numbers are to a further downturn. The answer, it turns out, is that a further decline in 2Q19 is quite easy to achieve.

Big components of GDP, like personal consumption expenditure (PCE) are not particularly volatile. That said, the 0.1% QoQ growth of PCE in 1Q19 was a sharp fall from 1.0% in 4Q18. That 4Q18 figure was itself a bit of a fluke. Though based on a relatively sombre assessment of the Korean labour market - employment and wages - we reckon something like 0.3% QoQ would be a reasonable starting point for PCE in any quarterly GDP calculation.

Gross fixed capital formation (GFCF) is more volatile. But the private elements of this, which fell 0.3% in 1Q19, could easily fall further in 2Q19 without some pick up in demand for global technology (semiconductors). We aren't seeing that yet, so another -0.3% figure in 2Q19 seems like a fair guess. Public capital formation fell 15% QoQ in 1Q19. The government has a KRW 6.7tr stimulus package ready for implementation. They say it could be worth 0.1pp of GDP. That seems about twice as much as is likely, but nonetheless, we can reverse the 1Q19 public GFCF decline in its entirety, with an expectation of further public sector support in 3Q and 4Q19.

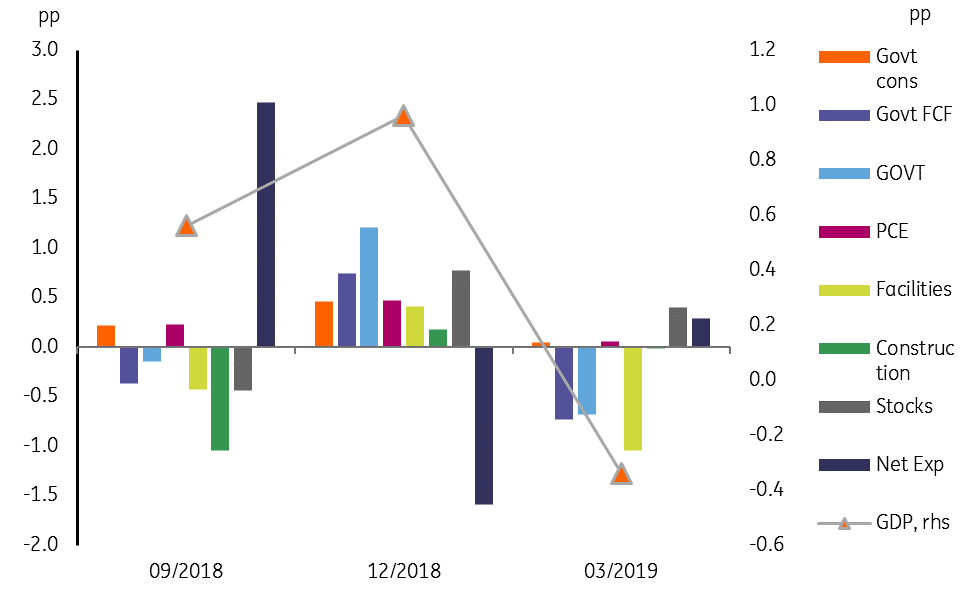

Contribution to QoQ GDP growth by expenditure component (pp)

Inventories and net exports could pull 2Q19 down

The biggest risks to growth in 2Q19 come from the inventory and net export terms. There is usually some negative correlation here, such that a terrible inventory figure will be partially offset by better net export figures and vice versa. In 1Q19, inventories added to GDP to the tune of about KRW 3.1tr. That was up about KRW1.5tr from the previous quarter and added 0.4pp to GDP after a very helpful 0.8pp in 4Q18.

But although imports will most likely feed into that inventory measurement, imports actually fell in 1Q19, and by considerably more than exports, providing an additional boost to GDP (imports are a drag on GDP, so falling imports represent a GDP boost) of about 0.3%QoQ. Exports don't look likely to show any substantial near term improvement, but even if imports remain weak in 2Q19, after their recent dismal performance, they may decline somewhat less relative to exports in 2Q19. The positive net trade contribution of 1Q19 (imports fall more than exports) could revert to neutrality or even a slight drag in 2Q19. As for inventories themselves, after two-quarters of unwanted build, we would look for them to be drawn down in the second quarter.

Whilst this is more of a sensitivity exercise than a strict forecast, tweaking next quarters figures in this way shows that is is quite easy to generate a further small contraction in overall GDP, and thereby a technical recession. And this is why we think the BoK will be forced to cut, maybe more than once.

What does this mean for the BoK?

The last Bank of Korea policy meeting just over a week ago left rates unchanged at 1.75%. The last change in BoK policy was as recent as November 2018, when they raised rates by 25bp, based on a not terribly convincing argument of high Seoul house prices and high household debt. The most recent meeting trimmed GDP growth forecasts for 2019 slightly to a "mid-2%" level from 2.6% at the January projection. To come even close to this will need (non-annualised) QoQ growth of more than 1% in every quarter until the year-end. In our view, that is simply not going to happen. In response to these latest figures, we think GDP growth for 2019 will do well to exceed 1.5%, which is our new full-year forecast and one that comes pre-loaded with plenty of downside risk.

The BoK's inflation forecasts are somewhat more realistic, in our opinion, than their growth numbers, with inflation expected to remain below 1% for some time. This is also a downward projection from January, but the forecast recovery to low to mid-1% in 2H19 again seems questionable and probably stems from unrealistic growth assumptions.

While the BoK may be relying on government stimulus to do the heavy lifting of combatting the current gloom, the current budget package seems insufficient for the task. We believe the BoK will have to provide some additional support with a rate cut this quarter. Moreover, further fiscal stimulus will also be needed before too long. Korea's good public finances make this an easy choice. Even so, we would not rule out the BoK having to step in to provide further support with another cut later in the year if the hoped-for 2H recovery does not take hold or is weaker than projected.

And the KRW?

Our 2Q19 forecast of USDKRW 1150 has now been smashed with 1160 reached today. We had a 3Q forecast of 1150 too. Both now seem too optimistic, though these forecasts were already at the very gloomiest end of consensus until recently. USD/KRW 1180 seems like a sensible mid-term target for the time being, and we will come up with a more thoughtful quarterly profile shortly.

Download

Download snap

25 April 2019

What’s happening in Australia and around the world? This bundle contains 9 Articles