Korea: August export growth slows and risks to outlook grow

Korea's exports grew at a slower pace in August and the trade deficit widened to the largest recorded. Worse still, the manufacturing PMI deteriorated further in August, suggesting sluggish exports and manufacturing will continue for a while. We have downgraded our GDP forecasts for 2022 and 2023.

| 6.6% |

Exports in August% YoY |

| Higher than expected | |

The trade balance deteriorated significantly as the growth of imports outpaced that of exports

Exports in August grew 6.6% YoY (vs a revised 9.2% in July), beating the market expectation of 5.6%. By export items, petroleum (113.6%) and automobiles (35.9%) led the increase, but semiconductors, accounting for about 20% of total exports, decreased by -7.6%. By destination, exports to the US (13.7%) and EU (7.3%) increased while exports to China (-5.4%) continued to decline for a third month. We expect that China's slowdown and weak demand for mobile phones and other IT devices will continue to put pressure on semiconductor exports, but automobile exports will pick up some of the slack.

Imports in August surged far more than expected, rising by 28.2% YoY (vs 21.8% in July) mainly due to rising energy imports (91.8%), which resulted in the trade deficit widening to a record USD -9.4 billion in August (vs USD -4.8 billion in July).

Trade deficit almost doubled in August

Manufacturing PMI worsened in August with weak underlying details

Korea's manufacturing PMI fell to 47.6 in August (vs 49.8 in July), which is the lowest reading since July 2020, and keeps it below the neutral 50 level for a second month. Output and new orders both dropped quite sharply, while new export orders also fell. The manufacturing PMI is a good forward-looking indicator for estimating GDP. The weakness in PMIs suggests that actual activity data will decline through the end of the year, and more importantly, we expect further declines as the PMIs of Korea's main trading partners such as the US, China, and other Asian countries are also weakening.

Manufacturing PMI suggests a contraction in the near future

GDP forecast revision and KRW outlook

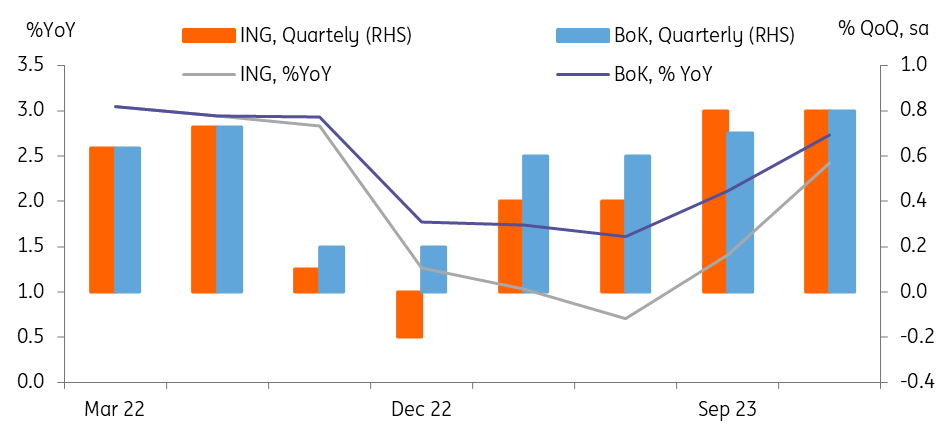

On a separate note, the Bank of Korea released its preliminary 2Q22 GDP outcome, which was the same as the advanced estimate of 0.7% QoQ sa (2.9% YoY). Combining the trade deficit data with the weak PMI data and yesterday's weaker-than-expected industrial production outcomes, we have decided to downgrade our GDP forecast to 2.5% YoY (vs 2.6% previously) for 2022 and to 1.4% (vs 1.6% previously) for 2023. We think that the third quarter will post a small gain mainly led by private consumption and construction growth, but negative growth is likely in the fourth quarter when the rise in debt service costs weigh on household spending and trade conditions worsen as a result of weakening global demand.

For the currency, we expect that the trade deficit will put more pressure on the KRW. Although we believe that the recent KRW weakness is mostly driven by the global dollar strength, but the trade deficit will not be supportive for the KRW in near future. Consequently, we think the KRW will depreciate further to 1,380 from the current level of 1,350.

We expect negative quarterly growth for the fourth quarter

The Bank of Korea will continue to raise rates despite growing concerns about slowing growth

We think the Bank of Korea's strong commitment to containing rising inflation will be valid through to the end of the year. But, the recent data releases - July production, August exports, and manufacturing PMI - suggest quite a rapid growth slowdown during the second half of this year. The BoK will soon have to consider the growth aspect in its policy decisions. We think that the Bank of Korea will likely end its hike cycle at 3.00% in November.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap