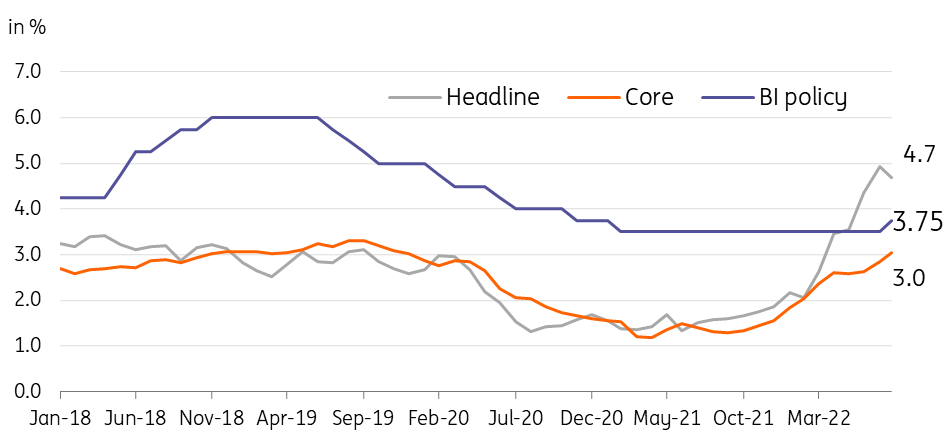

Indonesia: Headline inflation at 4.7% ahead of planned fuel hike

Price pressures are heating up in Indonesia with core inflation on the rise

| 4.7% |

August inflation |

| Lower than expected | |

August inflation at 4.7%

Price pressures remained elevated in August with core inflation inching up to 3% year-on-year from 2.9% in the previous month. Higher prices were recorded across the CPI basket with at least five out of the 11 subcomponents posting inflation above the central bank’s target. Price pressures were noted in utilities, education, personal care and other services, and restaurants, which all posted faster inflation in August. Meanwhile, headline inflation dipped as food beverage and tobacco inflation was at 8.2%, still elevated but down from 10.3% the previous month.

Inflation in Indonesia has stayed relatively manageable for most of 2022, however it appears that pricey food and energy imports have finally pushed up Indonesia’s core inflation with items in other services and restaurants seeing faster price gains.

Inflation elevated even ahead of fuel price hike

Planned fuel price hike to keep central bank on hawkish bias

Bank Indonesia (BI), a previous policy dove for 2022, finally hiked policy rates at the 23 August meeting. BI Governor Perry Warjiyo cited the pending price hike for Pertalite, Indonesia’s subsidised fuel, as one of the major factors for the preemptive and unexpected rate hike. Headline inflation is well past target and the planned fuel price hike all but ensures that price pressures will stay elevated in the coming months.

As much as 58% of the CPI basket has inflation above target and we expect rising transport costs will likely lead to further price increases across the CPI basket. We believe brewing price pressures alongside the planned fuel price hike to prod BI to retain its hawkish bias with at least two more rate hikes carried out before the end of the year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap