Korean activity data point to a cloudy third-quarter

According to recent industrial production, exports, and survey data, domestic demand will slow further, while a mediocre recovery is expected for exports. Government support to boost domestic demand will buffer the sharp contraction in consumption

| -8.4% |

Exports% YoY |

| Higher than expected | |

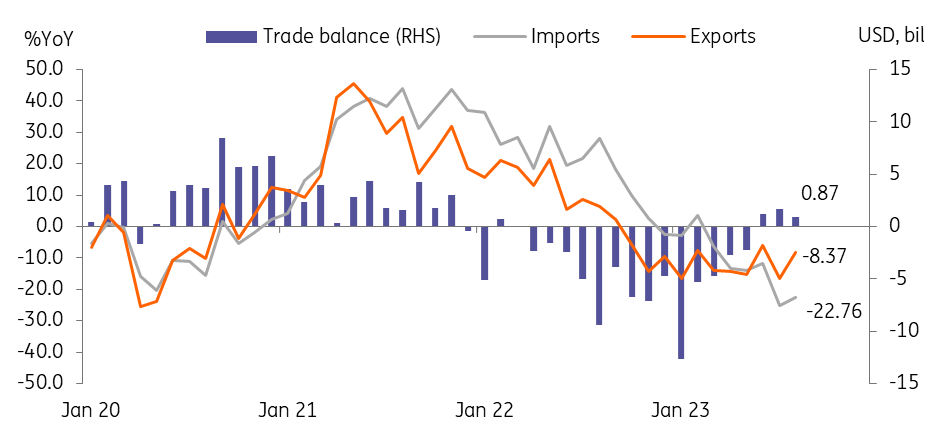

Exports continued to fall in August

Exports declined by -8.4% year-on-year in August (vs -16.4% in July and a market consensus of -11.8%), extending its decline trend for 11 months. However, imports fell -22.8%, even faster than exports, thus the trade balance recorded a surplus of US$869m in August.

Six out of 15 major export items increased with robust transportation equipment exports (vehicles 28.7%, vessels 35.2%). However, semiconductors (-21%), oils (-35%), petrochemicals (-12%), and steels (-11%) declined as price effects worked unfavourably.

By export destination, exports to the US (2.4%), EU (2.7%), and the Middle East (6.7%) rose firmly on the back of strong vehicle and machinery exports while exports to China (-19.9%) continued to fall, but at a slower pace than in the previous quarter. Looking ahead, the decline in exports will likely narrow, with a return to growth only possible by the end of the year.

The trade surplus has continued for three months in a row

Semiconductors are key

Export data suggest that chip exports have gradually improved compared to January as the contraction of exports continuously narrows. We believe that this is mainly due to base effects rather than the industrial cycle turning favourable. We believe that chip exports in value terms will continue to improve by the end of this year mostly supported by the low base last year, but that in volume terms will remain at the current level at the best.

Manufacturing industrial production data showed that semiconductor production dropped by -2.4% month-on-month seasonally adjusted in July, the first decline in five months. Major chip makers announced their production cut plans early this year, and we finally saw some of those promised reduction cuts in July. We think the production cuts will continue for a couple of quarters as inventory levels stay at an elevated level.

Thus, the rebound of the chip cycle will probably come even later than the end of this year. Still, we are optimistic that AI chips will likely outperform in the near term, but the overall semiconductor demand condition will not improve meaningfully at least for a couple of quarters.

Semiconductor cycle hasn't bottomed out yet

Domestic demand is expected to worsen further

Consumption and investment also slid in July with retail sales and facilities investment down -3.2% MoM seasonally adjusted and -8.9%, respectively. Worrying about the sharp decline in consumption and service activity, the government decided to extend the Chuseok holiday and provide a travel voucher programme to boost domestic demand.

This will temporarily support household consumption in the near term. However, we are still concerned about the ongoing slowdown in construction and facility investment, which will drag on growth over the next few quarters.

Lacklustre survey data also add concerns to the near-term outlook

Manufacturing PMI and local business survey slid in August. The Bank of Korea's Business Survey Index outlook for manufacturing declined by four points to 67, the lowest level in five months while the manufacturing PMI retreated to 48.9 (vs 49.4 in July), staying in the contraction zone for 14 months. With semiconductor cycles showing no clear signs of bottoming out and growing concerns over softening global demand, the manufacturing slump is expected to continue this quarter.

Cloudy outlook from survey data

Third quarter GDP outlook

In terms of GDP, we believe that third-quarter GDP will decelerate to 0.2% quarter-on-quarter seasonally adjusted from 0.6% in the second quarter. The positive contribution of net exports will continue mainly as imports will decline faster than exports.

However, despite government support measures for consumption, domestic demand conditions will likely worsen further. We foresee a continuation of the contraction in investment with tight financial conditions for businesses, weak construction performance and sluggish consumption. Meanwhile, the Bank of Korea's policy priority will shift from inflation to growth with external and internal growth conditions deteriorating further.

GDP outlook: ING vs BoK

The Bank of Korea produces a bi-annual outlook for GDP. ING has converted it to quarterly-based growth.

Download

Download snap