Japan’s April trade data boosts growth story

Activity data continue to support what looks about as positive a story for Japanese GDP growth as we have seen for some time.

| 97.6bn |

Adjusted Trade BalanceJPY billion |

| Better than expected | |

Japan’s trade data for April have followed a similar path to that worn by some other Asian countries during the month, with export growth maintaining, but not extending the bounce from the weakness of 2016, but imports showing rather more resilience.

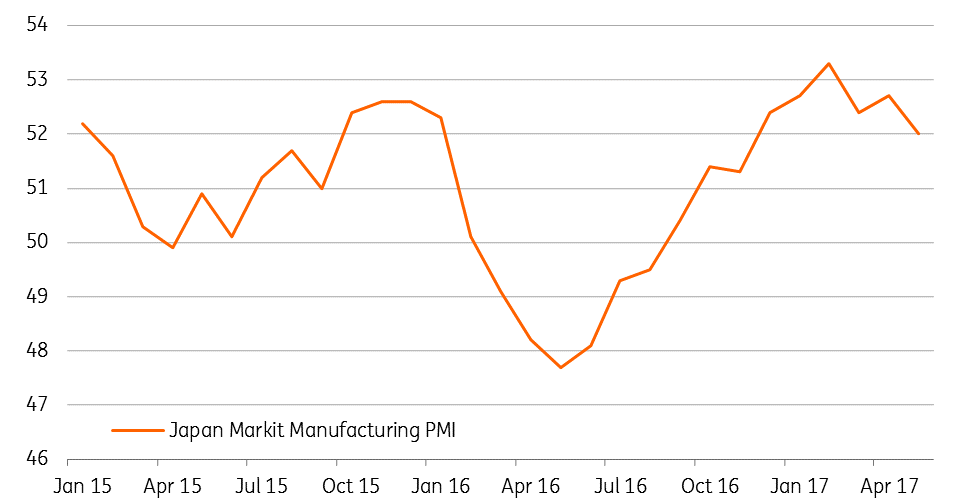

Japan's manufacturing PMI declines

(Nominal) import growth was most likely lifted by the April bounce in crude oil prices, and does not necessarily tell us all that much about Japanese domestic demand growth, or inventory re-building, except that these are clearly not collapsing. The Export figures on the other hand rose 7.5%, close to the 7.9% YoY highs recorded for April in the years following the big post-crisis surge in 2010. Volume data shows European demand for Japan’s exports picking up some of the slack from the US. The Trade balance (adjusted) remained positive, but narrowed to just under JPY100bn.

The bottom line

Where exports lead, investment is likely to follow. These data continue to support what looks about as positive a story for Japanese GDP growth as we have seen for some time. What is still missing is some wages growth – a global issue it seems – and some inflation. And Friday’s inflation numbers are likely to be more important for the (unlikely) prospect of any change in BoJ policy, and consequently for USDJPY.

Download

Download snap