Japan’s GDP declines 0.6% in 1Q

Is there more to this than meets the eye? Or is this like all the other weak G-7 GDP reports in 1Q?

Japan's GDP is choppy

The first thing you notice when you look back at a time series of Japanese GDP is that from time to time, it delivers either an outsize spike or a dismal-looking trough. Unlike some of its regional neighbours, Japan's GDP does not look as if it is massaged by statisticians to make it look more palatable. That also makes it more credible. And as a result, we need not worry overly when the occasional bad quarter comes. This was not a particularly shocking result. Markets were braced for 1Q18 weakness. The data merely came in a little weaker than had been imagined.

Amongst the weaker elements (all figures QoQ% non-annualised), private consumption (0.0%), residential investment (-2.7%), non-residential investment (-0.1%). Net exports were about the only bright spot, contributing 0.1pp to overall GDP growth.

| -0.6% |

1Q18 GDP QoQ annualisedDownward revisions to previous quarters |

| Worse than expected | |

Contributions to GDP growth (QoQ%)

Recent trend has been down

The outlook is improving

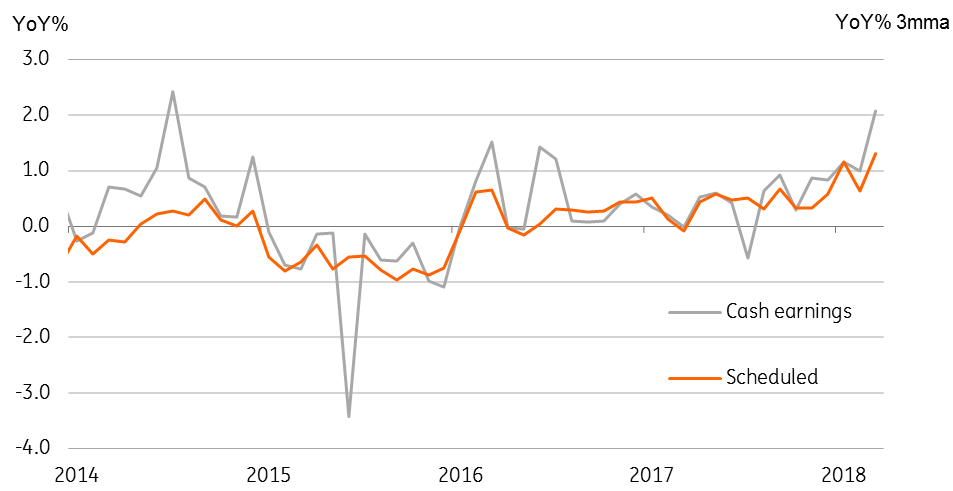

Just like the weakness in the US and Eurozone in the first quarter, we don't think this is more than a seasonal blip. Forward-looking indicators are painting a more upbeat picture. The best of these indicators is cash wages, which at 2.1%, are higher than they have been for a very long time, and that will help private consumption to bounce back into healthy territory in 2Q18.

Japanese Cash wages point to brighter future

This data does not help the BoJ

But whether it is real or just an aberration, we will have to wait now until August for confirmation of this rosy interpretation of not-very-good Japanese GDP data, with high-frequency data in the meantime only likely to partially assuage any residual doubts.

For the Bank of Japan, it means it is now virtually impossible to see it adjusting its quantitative and qualitative easing programme to a less accommodative setting this year, irrespective of what the European Central Bank manages to do in the background. Clearly it would be easier for the BoJ to make adjustments if it were not the only G-7 central bank trying to extricate itself from a bond purchasing dilemma. But the ECB doesn't look much closer to a change of policy either, despite market (over) reaction to some comments from the ECB's François Villeroy yesterday. This picture also does not help the yen either. Thoughts of a move towards USD/JPY 100 by the turn of the year look harder to justify today.

Download

Download snap

17 May 2018

Good MornING Asia - 17 May 2018 This bundle contains {bundle_entries}{/bundle_entries} articles