Japan: stronger-than-expected GDP supports BoJ policy normalisation

The easing of Covid-19 restrictions, along with government fiscal support, appears to have boosted consumption and investment. We anticipate some yield curve control (YCC) policy adjustment at the upcoming June meeting, as we believe the macroeconomic conditions now support sustainable inflation above 2%

| 0.4% |

%QoQ, sa1Q23 GDP |

| Higher than expected | |

First quarter GDP rose mainly due to strong domestic demand

Domestic demand offsets weaker net exports

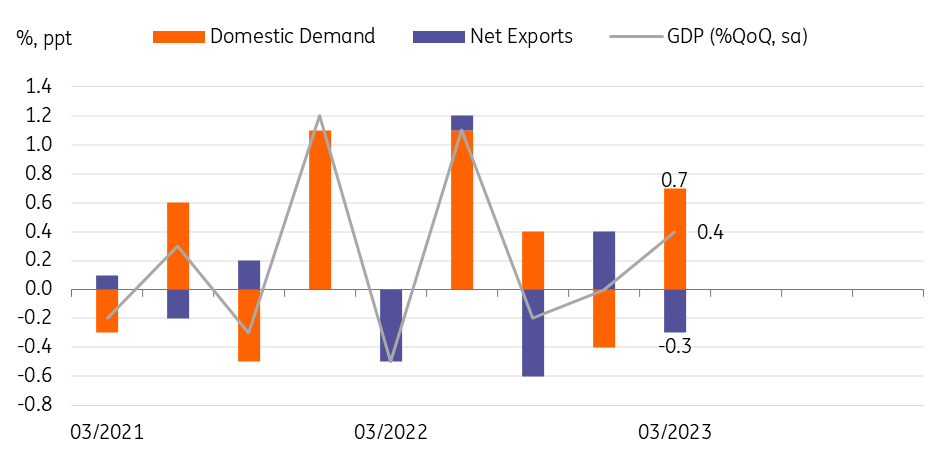

Japan's real GDP grew by 0.4% quarter-on-quarter seasonally adjusted (vs a revised -0.1% in the fourth quarter, a 0.2% market consensus, and 0.4% INGf') in the first quarter. A strong rebound in service activity related to the reopening of the economy was the main driver of growth. Private consumption rose 0.6% (vs 0.2% in 4Q22) on the back of the government's travel subsidy programme and a recovery in inbound tourism.

The upside surprise came from the unexpected rise in business spending, which rose 0.9% (vs -0.7% in 4Q22). Forward-looking machinery orders data suggest that strong service sector orders offset sluggish manufacturing orders. PMI data shows that the historically high level of service-sector PMIs has continued, suggesting that in the near term at least, service sector-led growth will continue.

Partially offsetting the strength of domestic demand, weak global demand conditions weighed on the nation's exports (-4.2%), and net exports made a negative contribution to the overall growth rate of 0.3% pp in 1Q23.

Forward-looking data suggest strong service growth will continue

Inflation outlook

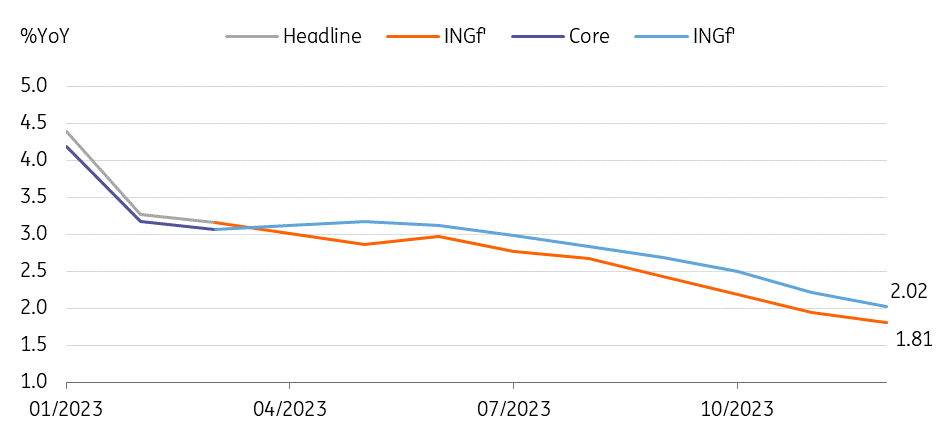

Yesterday, the Japanese government approved power utilities' plans to raise their rates for households, and price hikes are expected to take effect from 1 June. We have revised up our inflation forecasts accordingly to 2.8% YoY from 2.6% previously. We think headline inflation will stay above 2% for longer than expected but will eventually slow back below 2% by the end of this year. However, we think core inflation will stay above 2% throughout 2023.

Core inflation could stay above 2% throughout 2023

BoJ watch

The Bank of Japan will meet for its policy decision in June, so they still have time to review recent developments in inflation and other macroeconomic data. The most important factor in its policymaking is inflation. We don't think the power price hike is an immediate reason for policy action, as it is mainly a cost-push inflation driver. However, it will still boost core inflation to some extent.

The Bank of Japan will be very patient in taking any action on the policy rates, and we still think that rate hikes will not come until next year after the BoJ makes some progress in the policy review, announced last month.

June may be too soon for the BoJ's YCC policy adjustment, but we believe that the YCC policy should be normalized soon because it has distorted the functioning of financial markets beyond supporting the economy. Since April, when the new fiscal year began, if higher-than-usual wage growth persists and supports consumer spending, and if the financial market jitters surrounding the US banking sector calm down, we think the BoJ will make a decision on YCC policy sooner rather than later.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap