Australia: Wage price index supports further RBA tightening

While Australian wage growth remains moderate by international standards, the latest print is still high enough for the Reserve Bank of Australia (RBA) to justify further tightening

| 3.7% YoY |

Wage price indexup from 3.3% |

| Higher than expected | |

Wage growth is very lagging, but the RBA think it is important

In recent comments, the Reserve Bank of Australia (RBA) Governor, Philip Lowe, has made a lot out of rising wage rates and unit labour costs. And though we do not share his view that this is alarming - to us, these are highly lagging indicators of the economy or simple residuals of slowing growth - we can't deny that such data is likely to play a key role in shaping RBA rate decisions in the coming months.

At 3.7%, wage growth in Australia is still low by international standards (in the US it is 4.4%YoY for hourly wages and in the UK it s 6.8%YoY for weekly earnings ex-bonuses) and doesn't look particularly threatening. Even the rate of quarterly increase was steady at 0.8%QoQ, with no change from the previous quarter. But on a mechanical approximation, 3.7% is too high to be consistent with the RBA meeting its 2-3% inflation target (if it doesn't moderate, which it probably will).

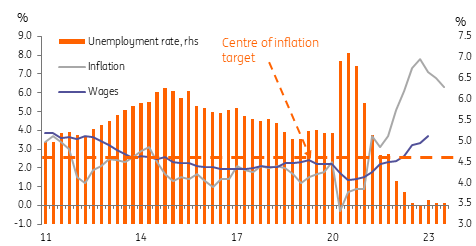

Australian wages, inflation and unemployment

Wage arithmetic

The simple calculation runs approximately as follows. If wage growth is ultimately passed on by firms in prices to maintain steady margins, then assuming about a 1% annual productivity increase, firms should be able to bear wage growth of up to 4% to keep price increases below the top of the 3% inflation target. If we are actually targeting the centre of the target range (2.5%), then 3.5% annual wage growth is the highest rate of wage growth that should be consistent with this over the long run. So today's wage price index growth rate of 3.7%YoY takes us above this threshold and implies further tightening from the RBA.

However, there are a lot of caveats to this.

The main one is the assumption about what proportion of wage growth can be absorbed by productivity. We hear a lot from Governor Lowe about low productivity growth. But productivity feeds off economic growth, which is slowing, and also the labour market, which hasn't yet meaningfully started to soften, though almost certainly will, given time. Consequently, productivity will inevitably experience a cyclical drop at times like this, while having no inflationary consequences whatsoever.

Saying this, even before the current economic slowdown, trend productivity growth in Australia did not look particularly impressive, with OECD estimates hovering around the zero mark through the immediate pre-pandemic years. If that really is the non-cyclical trend figure we should be using, then even very modest wage growth, well below current levels might start to squeeze margins and put upward pressure on prices.

The truth is, we just don't know for certain, and neither does the RBA. Such trend rates only become apparent long after the period with which we are concerned. What we can say, is that whatever the trend underlying productivity rate, and whatever wage growth is doing, inflation is already falling. The April figures will not fall by much, if at all, but then the following two months should see headline inflation dropping more sharply.

Further data on unemployment rates and employment growth could help shape the RBA's rate-setting decisions in the near term. The unemployment rate is still extremely low. But the RBA also appear to be mindful of the impacts of tightening they have already undertaken, and while data like today's are important, the RBA are not behaving particularly reactively on a month-on-month basis to the numbers, which makes assessing their reaction function even trickier.

Our current thinking is that a further 25bp rate hike of the cash rate target to 4.1% is likely. It could happen in June, though there is also an argument for the RBA taking their time to allow lagging data to respond to earlier tightening, and that means that the timing remains questionable.

And while some market participants favour two more hikes before the peak, we think that the resumption of the decline in inflation that will be apparent from May data onwards will limit it to one hike. But there isn't much to choose between the two alternative views.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap