Japanese recovery continues, but weakening labour data is a concern

According to various data released today, the Japanese economy is doing better than in the previous quarter. Industrial production and retail sales have rebounded solidly but labour market data softened somewhat in February. Therefore, the Bank of Japan will take cautious steps towards policy normalisation

| 4.5% |

Industrial Productionmonth-on-month, seasonally adjusted |

| Higher than expected | |

| 1.4% |

Retail salesmonth-on-month, seasonally adjusted |

| Higher than expected | |

Industrial production and retails sales improved more than expected in February

Industrial production rebounded 4.5% month-on-month, seasonally adjusted in February (vs -5.3% in January and a 2.7% market consensus). While industrial activity in February did not fully recover from the previous month's sharp decline (which was caused by China's lunar new year and snowstorm interruptions), we shouldn't underestimate that the outcome was better than the market consensus. Going forward, downside risks for IP are growing as weak global demand for IT products will likely hit exports. Export bans on chip-making machinery (announced today) will also have some negative impact from the second half of the year.

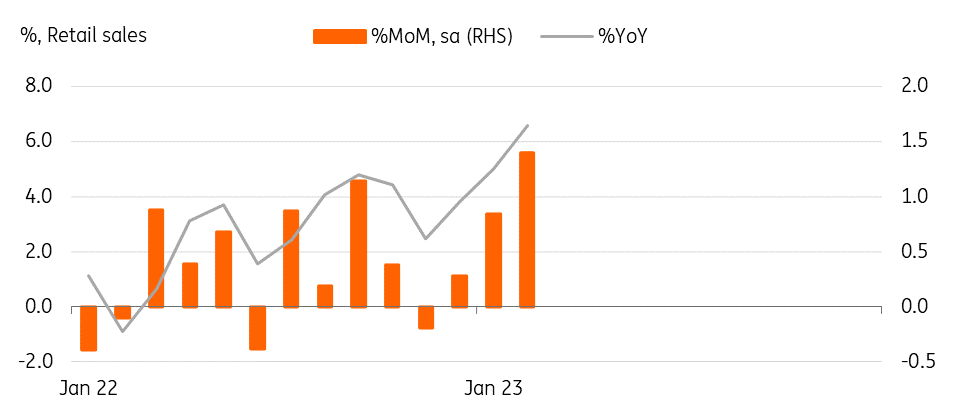

Meanwhile, retail sales rose solidly by 1.4% MoM sa in February (vs 0.8% in January and a 0.3% market consensus). The improvement was broad-based, with motor vehicles rising the most (5.4%). We expect Japan's reopening to boost private consumption going forward and that the recent decline in energy prices will benefit consumer purchasing power as well.

We expect the recovery to continue mainly led by services, but sluggish exports and manufacturing will drag on growth.

Gain in retail sales accelerated for three months

Tokyo CPI has continued to decelerate

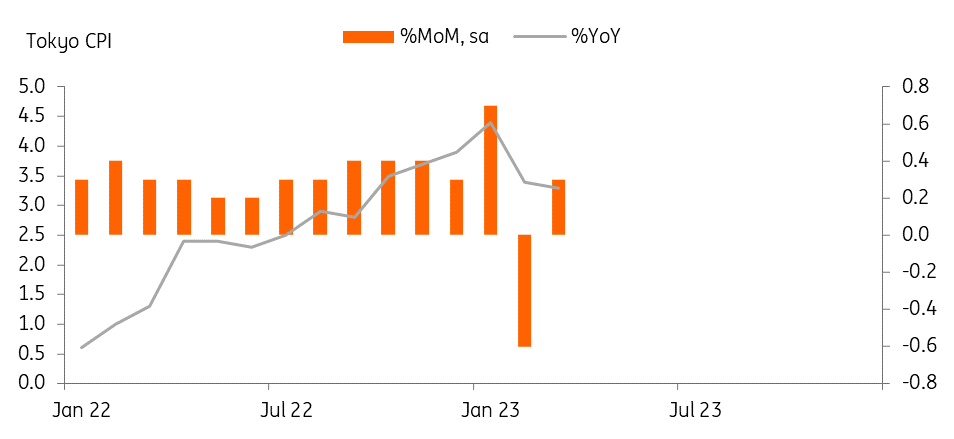

Consumer prices in Tokyo slowed to 3.3% year-on-year in March (vs 3.4% in February and a 3.2% market consensus). Base effects helped slowdown headline CPI while the government's energy subsidy programme lowered utility prices. However, inflationary pressures seem to be broadening as household goods (9.1%), clothing (4.3%), medical care (1.4%), and entertainment (2.4%) continued to rise. In Japan, a certain level of inflationary pressure is considered a good sign if wage increases follow. We believe that the second round effect of gains in commodity prices still remain while the reopening of the economy is also adding some demand side pressures.

Tokyo inflation slowed in February

Labour market data weakened in February

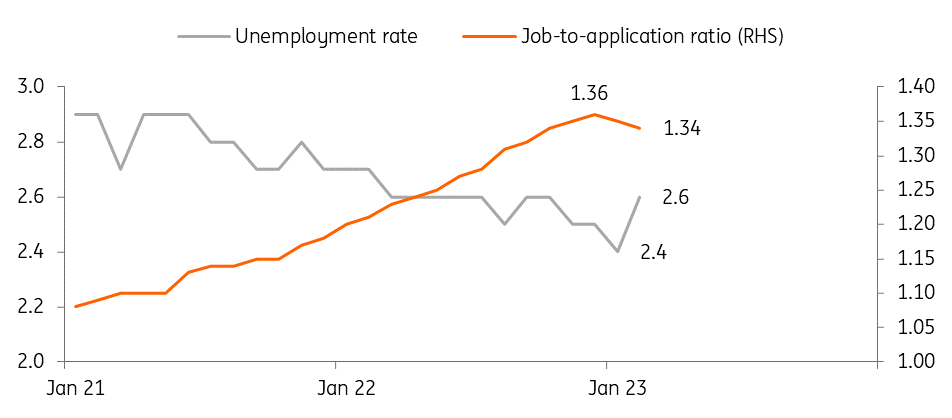

The weakest of today's data releases was labour market data, which was unexpectedly soft. The jobless rate rose to 2.6% in February (vs 2.4% in January and a 2.4% market consensus) and the job-to-application ratio also edged down to 1.34 (vs 1.35 in January and a 1.36 market consensus). Weak manufacturing and exports appeared to weigh on manufacturing employment, while employment in the services sector rose. We believe that this trend of weak manufacturing and solid services will continue for the time being.

International tourist arrivals have increased considerably since the reopening of the borders last December, and the government's travel voucher support programme for Japanese residents will continue to boost the service – tourism and leisure – industry and its employment.

Labour market conditions worsened in February

Bank of Japan watch

We expect the Bank of Japan (BoJ) to hold any monetary policy action at its April meeting, as it is just too early for the incoming governor Kazuo Ueda to make policy adjustments and there is no indication at this point that policy normalisation is urgent.

Given today's data – that the economic recovery is continuing while some inflationary pressure still exist – we think the BoJ could adjust its yield curve control (YCC) policy and change its forward guidance as early as June. We don't expect another adjustment of the upper limit widening but it is more likely to shorten the tenor of the yield curve from 10Y to 5Y. But, we still have to monitor how labour market conditions change over time. Local media has reported that several large companies are planning to raise salaries by more than 3% this year, which could bring about decent wage gains.