Japan: 4Q22 GDP rebounded, but less than expected

We expect the modest recovery to continue this year, but it is questionable whether it is going to be strong enough for the Bank of Japan to make progress in normalization as rapidly as expected by the market

| 0.2% |

4Q22 GDP(%QoQ sa) |

| Lower than expected | |

Disappointing 4Q22 GDP, but the recovery will continue in the current quarter

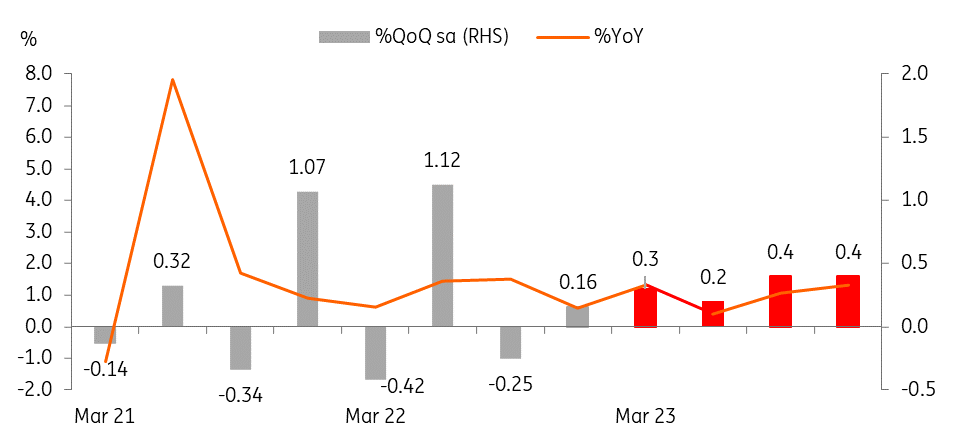

Today’s data was on the soft side because not only was the quarterly growth rate weaker than the market consensus of 0.5% but the previous quarter’s growth rate was downgraded to -0.3% (vs -0.2% initial estimate).

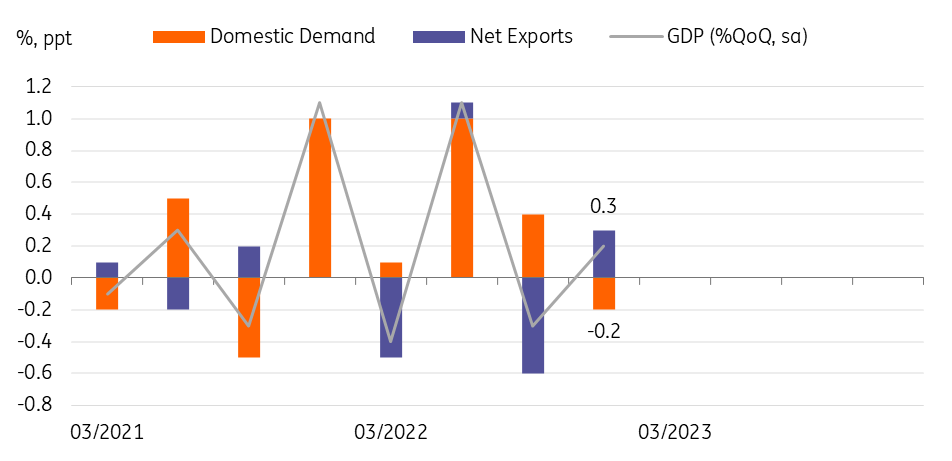

For the domestic demand components, private consumption (0.5%) led the growth. But both residential (-0.1%) and non-residential investment (-0.5%) fell, partially offsetting this. We believe that the government’s travel subsidy program has boosted service sector activity, and the government’s energy subsidy program is also expected to help ease the burden on households to some extent. Consequently, we believe that private consumption will remain the main source of growth in the current quarter, though its momentum may weaken. For investment, higher JGB yields may be a negative factor. But the reopening of China and stronger-than-expected US and EU economies could offset this. That said, monthly data from business surveys and core machinery orders still suggest a bleak outlook for investment this quarter. Taken together, we expect investment to remain weak but rebound meaningfully in 2H23. In the case of inventories, they actually dragged down growth by 0.5pp in 4Q22, but this probably suggests restocking in the quarters ahead.

For the external components, exports rose 1.4% but imports dropped 0.4%, resulting in a contribution to growth from net exports of 0.3pp. A stronger yen and weaker commodity prices worked in favour of improving net export contributions. Also, the sharp increase in foreign tourists was another reason for the improvement. We think that the reopening of borders will likely further support growth in the current quarter along with China’s reopening. In summary, we believe that GDP in the first quarter will accelerate modestly boosted by tourism related service activity and inventory restocklng.

4QGDP growth was mainly driven by external demand components

BoJ watch

Today’s weaker-than-expected growth data will give the Bank of Japan more reasons for caution. In particular, soft investment will be a concern. That is why we believe that the incoming new governor will find it difficult to start any normalization very soon and instead, will take time to analyze inflation and wage growth trends first. Eventually, however, we expect the new Governor to undertake a policy review and take a small step towards normalization.

GDP forecast : expect a modest recovery throughout the year