Inflation eats into strong wage growth in Hungary

The minimum wage increase, wage compression, labour shortages and increasing inflation expectations were all in play in Hungary's double-digit wage growth in January. But purchasing power growth was strongly discounted by inflation

| 13.7% |

Gross wages (YoY)ING forecast 15.2% / Previous 9.7% |

| Lower than expected | |

Gross wage growth came in strong in January, only a tad lower than expectations. The 13.7% year-on-year growth in salaries in the Hungarian labour market reflects a lot of developments. However, it doesn’t reflect the change in tax benefits or the tax exemptions for employees under 25 years old, which were introduced in January 2022. If we add those in, average net earnings including tax benefits were 14.8% higher than a year ago.

But before we get carried away, it's worth mentioning the impact of inflation on consumer purchasing power. With a 7.9% year-on-year headline inflation rate, real earnings increased by only 5.4% on a yearly basis. This is not bad from a historical perspective, but it is crystal clear that price changes are ripping a large chunk out of the net wage dynamics.

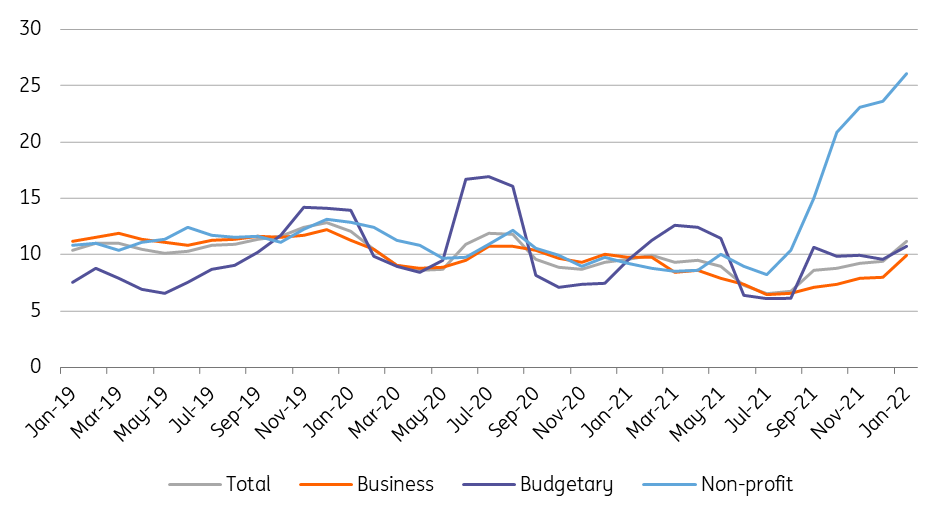

When it comes to the details, public and private wage growth were almost identical, showing a 12.8% and 12.5% year-on-year rise, respectively. The roughly 32% yearly salary increase in the non-profit sector reflects the ongoing wage settlements in education as several educational institutions have been reclassified as non-profits, following a change in their controlling authority.

Wage dynamics (3-month moving average, % YoY)

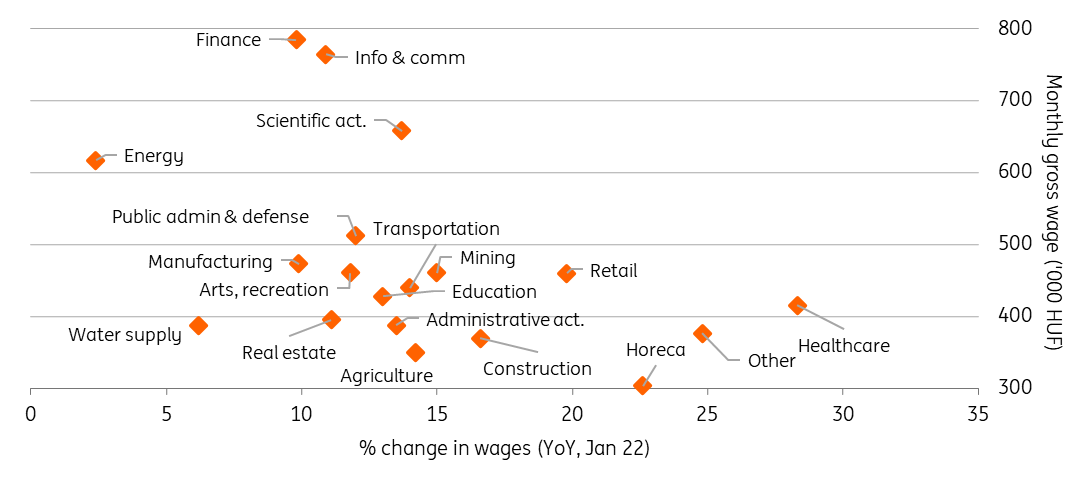

A significant driver of the strong wage growth was the wage settlements in several areas of the economy: education, healthcare, jurisdiction. On top of that, the 19.5% minimum wage increase (both for skilled and unskilled labour) from January 2022 also impacted average wage growth in the national economy. The impact of this is mostly visible in the sectors where the share of minimum wage earners is higher.

Here, we can single out construction, transportation and accommodation and food service (hotels, restaurants and catering) activities. In these areas, the average wage growth was significantly higher than the national average. Moreover, as these sectors were among the segments of the economy where the average (and probably median) wages were below their national economy counterparts, wage compression due to minimum wage increases triggered further salary changes. Labour shortages are also playing a major role in these sectors, thus all of these impacts culminated in the above-average wage increases.

Level and growth of average wages by sectors

According to recent business surveys, the willingness of the business sector to raise employment has shown only a moderate decline. The majority of this is coming from the manufacturing sector, where escalated supply chain issues are clearly impacting the employment outlook in the short term. In contrast, employment expectations in the retail trade and construction sectors – two sectors with above average wage growth dynamics – have even strengthened.

In this respect, the latest set of labour market data clearly supports our view that we will see more double-digit wage growth readings in the coming months. In 2022 as a whole, we expect a 15% year-on-year increase in gross wages due to minimum wage increases, labour shortages and rising inflation expectations. So, despite the war in Ukraine we still don’t see a major downward impact on Hungarian wage dynamics. On the other hand, growth in purchasing power will be much more subdued with inflation likely moving above 9% on average in 2022, so we see real wage growth around 5-6% this year.

Download

Download snap