Bank Indonesia holds rates at its first meeting of 2024

Bank Indonesia holds rates at 6% and is likely remain on hold for most of 2024

| 6.0% |

BI policy rate |

| As expected | |

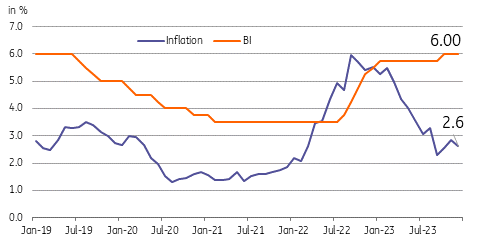

BI keeps rates at 6%

Bank Indonesia (BI) kept policy rates at 6% today despite pointing to a less upbeat outlook for the global economy. It retained its outlook for domestic growth, with GDP expected to expand between 4.7-5.5% year-on-year. The central bank also revised its forecast for Indonesia’s current account surplus to range between 0.1% to 0.5%, narrower than the previous estimate of 0.9% of GDP. Despite some lingering concerns about price pressures, Governor Perry Warjiyo still believes inflation will settle within BI’s 2024 target of 1.5-3.5%.

Bank Indonesia likely kept policy rates untouched while keeping an eye on a potential inflation flare up and remaining aware of the need to maintain support for the IDR. The IDR remains pressured to open the year, down roughly 0.5% for the year.

BI likely to extend pause well into 2024

BI likely on hold for first half of the year

BI reiterated it would continue with its currency stabilisation measures, with the central bank likely to intervene and provide support to the IDR during episodes of volatility. Governor Warjiyo also shared that BI expects the Federal Reserve to begin cutting policy rates in the second half of the year, suggesting that the BI will also likely wait for the latter half of the year before considering potential monetary easing. Warjiyo also indicated that he would need a firmer IDR and slower inflation before he pulls the trigger on rate cuts.

With the IDR still under pressure and inflation slightly above the central bank’s inflation target midpoint, we believe Bank Indonesia will keep rates at 6% for the first half of the year but will likely shift to accommodation once the Fed starts cutting policy rates.

Download

Download snap