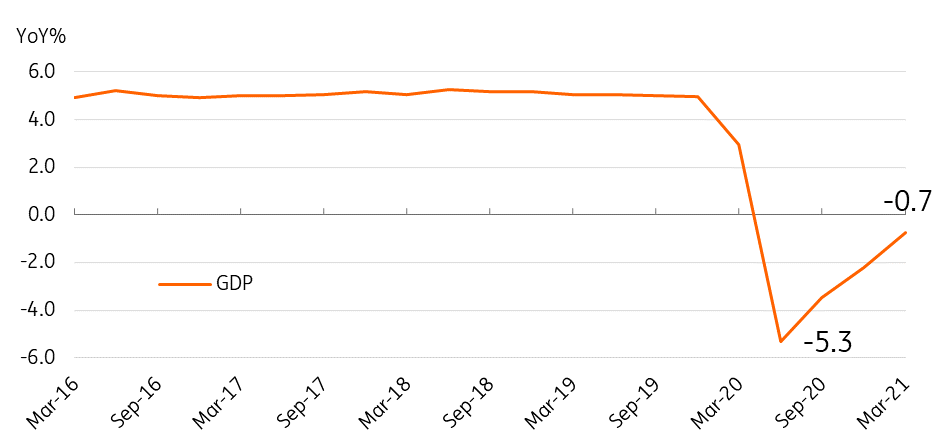

Indonesia’s 1Q GDP misses estimates but a rebound is coming

Indonesia’s economy contracted 0.7% year-on-year in the first quarter as domestic demand stayed soft

| -0.7% |

1Q GDP growth (year-on-year) |

| Lower than expected | |

1Q GDP posts year-on-year contraction of 0.7%

Indonesia’s economy shrank modestly in the first three months of the year, lower by 0.7% compared to 1Q 2020 and down 0.96% compared to the previous quarter. A spate of natural calamities and a spike in Covid-19 infections at the start of the year scuttled hopes for a strong pick-up in economic activity, prompting authorities to allocate more funds to fiscal stimulus to bolster the recovery. Domestic demand remained soft, as evidenced by disappointing retail sales data (-17.1% as of March) reported by the central bank while also manifesting in subdued core inflation which is averaging 1.4% for the year (vs 2.3% in 2020). Authorities have retained their official growth estimate for the year, with GDP expected to settle between 4.3-5.3% although Bank Indonesia (BI) recently trimmed ITS forecast to 4.1-5.1% likely due to the 1Q performance.

Indonesia GDP growth

Turning the corner?

Indonesia continues to bet on an aggressive vaccination rollout to help boost the economic recovery with more than 20 million doses administered as of 4 May. As more and more citizens receive their vaccines, we can expect consumer demand to recover somewhat to help drive a rebound in GDP in the second half of the year. Prospects for a rebound in GDP are also noted in improving export performance (up 30.7% in March) as well as surging manufacturing activity with the latest IHS Markit PMI manufacturing index hitting the highest level to date. We continue to expect better growth numbers from Indonesia with prospects for faster growth tied largely to the vaccination efforts. Increased protection from the vaccine will help stimulate domestic demand while manufacturing activity will also likely continue to expand as global trade improves and exports pickup. The potent mix of fiscal and monetary stimulus alongside the vaccination rollout should translate to an overall improving growth outlook in the coming quarters.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap