Reserve Bank of India hikes rates by 40bp

In an unscheduled meeting, the Reserve Bank of India (RBI) just hiked policy rates by 40bp to 4.4%. More hikes will follow

| 4.40% |

Repo rateSurprise 40bp hike |

| Higher than expected | |

It was only a matter of time... but this suggests concern is mounting

It didn't take long for the RBI to reconsider its stance at the April meeting, where, despite inflation coming within a whisker of 7.0% year-on-year, rates were left unchanged. At that meeting, the members of the Monetary Policy Committee (MPC) voted unanimously on the following statement, which was that policy should "remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth".

The main impetus for this unscheduled hike seems to have been a re-think of the inflation outlook, with RBI Governor Shaktikanta Das commenting: "Core inflation is likely to remain elevated in the coming months, reflecting high domestic pump prices and pressures from prices of essential medicines. Renewed lockdowns and supply chain disruptions due to the resurgence of Covid-19 infections in major economies could sustain higher logistics costs for longer. All these factors impart significant upside risks to the inflation trajectory set out in the April statement of the MPC".

Prices of gasoline in the bigger cities are already up about INR10 since mid-March, and with food prices likely to get an additional upward lift from Indonesia's palm-oil export ban, already high food prices are likely to rise further.

The RBI may have been emboldened to move now by the bigger-than-expected Reserve Bank Australia hike earlier in the week, and possibly also felt that the rupee could be vulnerable to the Fed's likely 50bp rate rise within only a few hours of this decision.

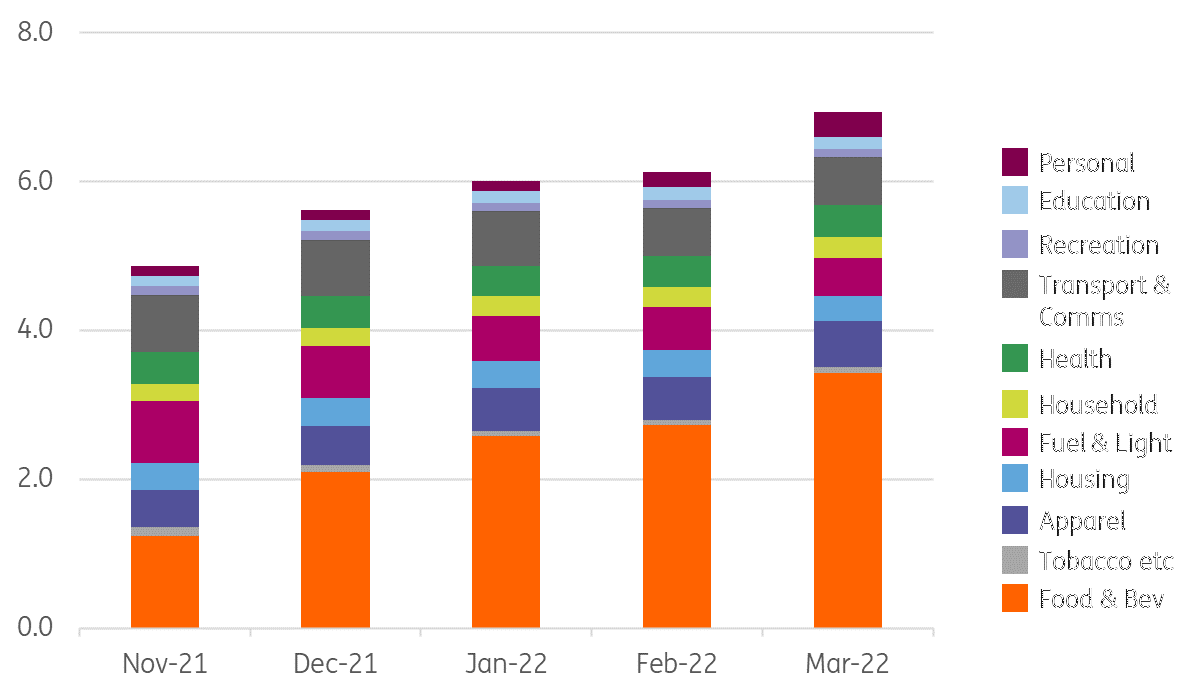

Indian headline inflation by component (contribution to YoY%)

Alakazam – rate hikes!

In terms of what we should expect now that the rate hike genie has been released from the bottle, the simple answer is "more". Just how much and how soon will presumably be a function of how much further inflation rises, the extent to which this spills into second round wage and price effects, and how long this then persists.

The latest statement adds that "the MPC expects inflation to rule at elevated levels, warranting resolute and calibrated steps to anchor inflation expectations and contain second-round effects". The addition of the word "calibrated" suggests that the RBI is not going to panic and start aggressively hiking, as does the repeated inclusion of the "remain accommodative..." phrase.

That said, the balance of risk seems skewed to policy accommodation being reduced overall, even if it still remains somewhat supportive, and that seems to suggest that policy rates should at least begin to close the gap with inflation, even if only marginally and cautiously. With this in mind, we have raised our end-of-year forecast for the repo rate to 5.4%.

One aspect we completely agree with the RBI on is that "heightened uncertainty surrounds the inflation trajectory". Geopolitical tensions, supply chain disruptions and the vagaries of whatever the monsoon will throw at the Indian economy this year mean that our new forecasts, like the latest forward guidance from the RBI, should be treated as "work in progress", not a hard expectation.

Download

Download snap