Hungarian retail sector makes a strong start to the year

The retail sector’s strong performance in January was due to a high turnover in food shops, but it would be too early just yet to say retail sales have turned a corner

| 5.4% |

Retail sales (YoY)Previous (3.8%) |

First of all, the statistical office has changed the methodology of how it calculates turnover in retail shops as it has started to use data from online cash registers. Against this backdrop, any comparison to the market consensus doesn't make much sense. However, as the time series was revised from 2015, we have some opportunity to assess January data.

After a surprisingly weak December, retail sales turnover increased by 5.4% year on year, which is less than last year’s average of 6.6%, but stronger than the data from the past few months. The January performance is even more surprising if we take into consideration the really strong base of January 2018. The data revision, however, didn't alter the big picture, which means that the retail sector’s turnover increased at a slowing pace in 2018, despite some outliers. The main question is if January data is an outlier again, or the start of a new trend. We’d rather prefer – at least for now – the outlier story. Our presumption is based on the details.

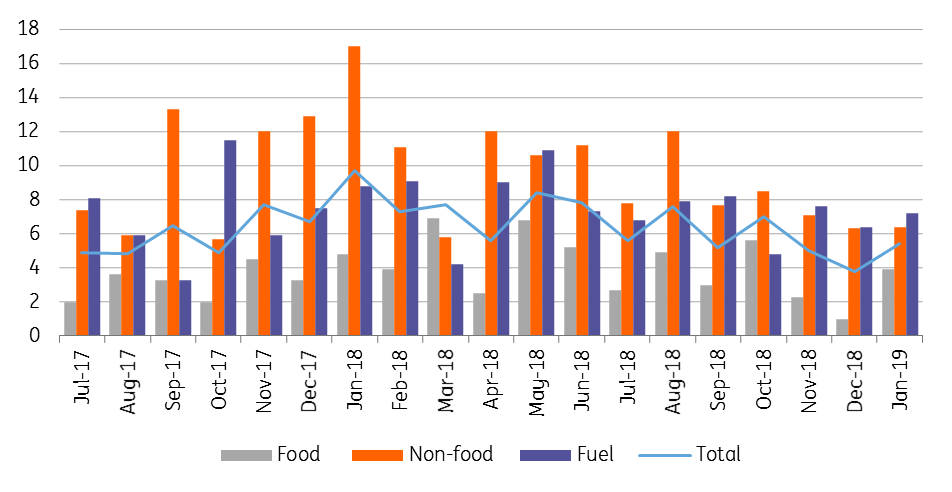

Breakdown of retail sales (% YoY)

Working-day adjusted

The turnover in food shops was the strongest force in the upside surprise, as it showed a 3.9% YoY increase, the strongest since October 2018. In the meantime, the turnover in non-food shops increased by 6.4% YoY, which is still strong but lagging the 10-12% growth seen in early 2018. Thus we see a significant deceleration.

As households are filling up their homes with new goods, replacing the old ones (electronic items, furniture, household goods etc.) the attention turns to buying services, which aren't included in these statistics.

For 2019, despite the strong start, we see a 4% increase on average in the retail sector this year. The deceleration compared to 2018 is stemming from the lower rate of real wage growth due to the accelerating inflation and the fading effect of the postponed consumption (visible in non-food shops).

On the other hand, as real disposable income continues to rise, we see a shift from consumer goods to buying more services, holding back the retail sector’s potential in the future, but having a positive effect on the services sector.