Hungary shows signs of wage-push inflation

Companies are trying to fight against narrowing profitability amidst the 'cost storm'

| 9.7% |

Gross wages (YoY)ING forecast 10.5% / Previous 10.1% |

| Worse than expected | |

Wage growth came in at a double-digit rate in November but showed a minor deceleration in December. However, that's not to say the 9.7% year-on-year increase in gross and net wages is weak.

The most interesting part of the incoming data is that this was below the market consensus as the market had expected further acceleration in wage growth. This was based upon the November reading, where the regular wage growth was lower than the average salary increases, pointing towards a strong seasonal bonus payment (the bonus season used to be in December). We had expected this pattern to continue, especially considering the Hungarian economy managed to put together a record year in 2021 with 7.1% GDP growth.

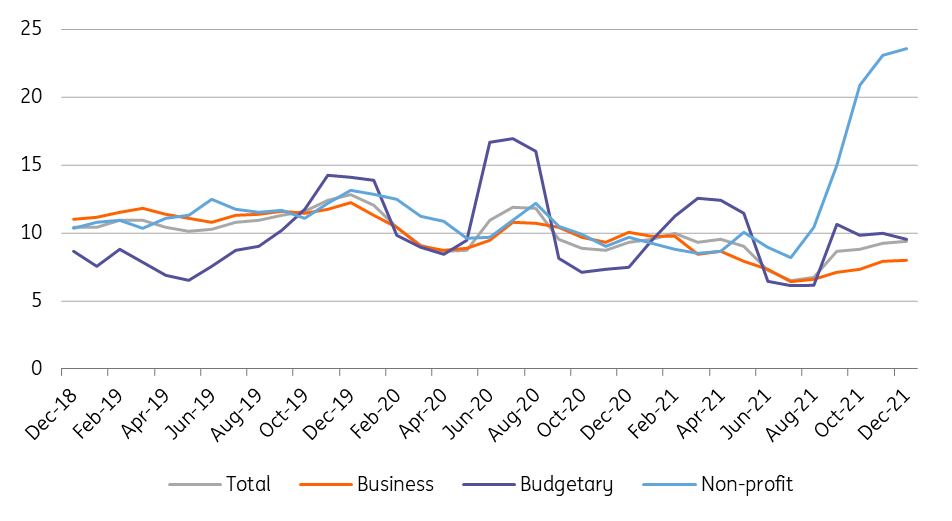

Wage dynamics (3-month moving average, % YoY)

Regular wage growth also came in at 9.7% year-on-year, thus there wasn't any extra upside pressure on wages coming from bonus payments. This lower-than-expected bonus payment in a record year could point to the changing behaviour of corporates. Employers are facing a really tough 2022 with minimum wages (both for skilled and unskilled labour) rising by 20% since January, which has impacted the whole wage scale and created further wage pressure. On top of that, the shortage economy and energy crisis are still rumbling on, further adding to the cost side pressure.

In other words, companies may want to cut costs during this year through reduced premium payments combined with stronger repricing. With a combination of these, they will try to maintain their previous profit margins or at least curb the narrowing margins. Nevertheless, we continue to see double-digit average wage growth in 2022 as a whole. In addition to the 20% increase in minimum wages, we call an increase in the average wages at roughly 15% due to the alleviation of wage congestion.

The inflationary impact of the significant rise in labour costs was already evident in the January inflation data, which showed three times stronger revaluations at the beginning of the year than history shows, and repricing affected a much wider range of goods and services than usual. Against this backdrop, we think that the price-wage spiral of wage-push inflation has already become visible in Hungary. This can only be alleviated by combining the forces of monetary and fiscal policies, thus, in our view, the rate hikes must be accompanied by a more restrictive fiscal policy during 2022.

Download

Download snap