Hungary: Rising inflation, resistant central bank

Headline inflation keeps rising, not only on the back of fuel prices but because of underlying processes too. The central bank is still tolerating this, but what happens if it constantly exceeds expectations?

| 3.5% |

Core CPI ex-tax (YoY)Previous (3.2%) |

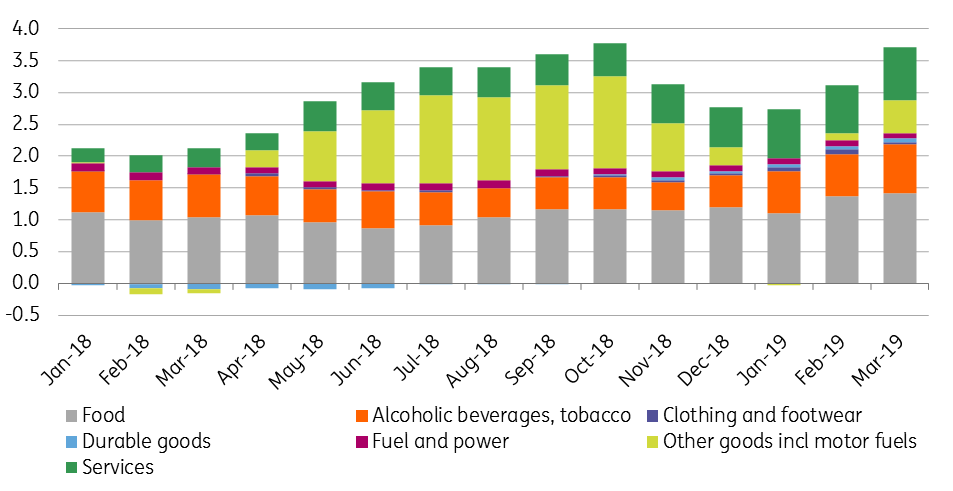

Headline inflation continued its acceleration, as it jumped to 3.7% year on year in March from 3.1% YoY in February. The higher-than-expected figure is the second highest reading in the past six years with the main drivers being food products, tobacco, and alcoholic beverages, as well as services and fuel.

Food prices grew by 5.4% YoY contributing 1.4ppt to CPI as vegetables, flour and eggs became more expensive. Prices were also pushed higher by bad weather and new taxes on unhealthy food products, introduced in January 2019. Tobacco and alcoholic beverage prices rose by 8% YoY in March, mostly because of higher taxes.

The highest change in contribution was for fuel which added five times more to the CPI in March than in February. Also, services contributed significantly to CPI increase, caused by the double-digit wage growth and base effects.

The composition of headline inflation (ppt)

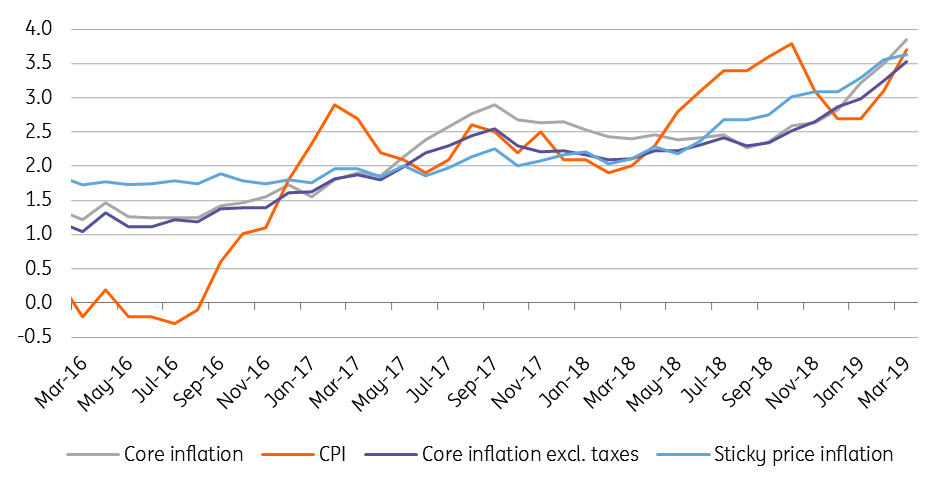

As for the underlying inflationary processes, core CPI accelerated again, reaching 3.9% YoY in March, 0.4ppt higher than in February, and the highest reading since 2012. Core CPI excluding indirect taxes came in at 3.523% YoY, which is significantly higher than in February.

But most importantly, it exceeded the expectations of the National Bank of Hungary.

Headline and core inflation measures (% YoY)

The central bank communicated last month that they are more tolerant of inflation above target, both headline and core CPI ex-tax. Although wage growth is pushing underlying inflation higher, it will be offset by the slowdown in the global economy. Thus with one-off steps, price stability can be achieved and maintained this year, and there is no need for a full tightening cycle, according to Vice President Nagy.

Also, the dovish Fed and ECB are easing tightening pressure when it comes to the central bank of Hungary. Nevertheless, the “data-driven” central bank will keep monitoring the economy, and if inflationary measures constantly exceed expectations (just as they did in March), another round of one-off tightening will become more likely.