Hungary: Inflation pressure weakens

Headline CPI decelerated to 2.1% year-on-year in December mainly due to the strong base effect of fuel prices. The National Bank of Hungary is unlikely to change policy on this

| 2.1% YoY |

Headline inflationConsensus (2.2%) / Previous (2.5%) |

| Worse than expected | |

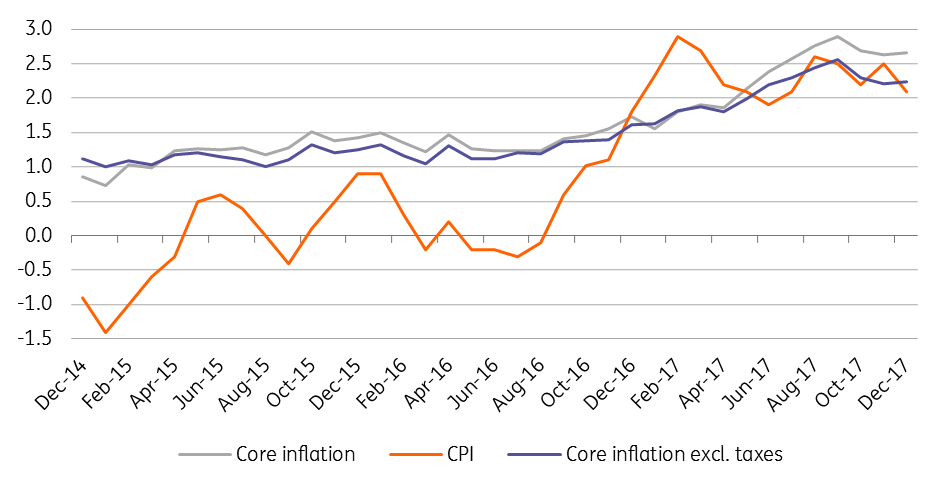

Headline CPI declined to 2.1% year-on-year in December, slightly below market expectations, but matching the NBH’s call. Inflation came in at 2.4% in 2017 as a whole. Meanwhile, core inflation, which excludes raw food and energy prices, remained roughly flat at 2.6% YoY in the last month of 2017. For the whole year, the average rate of core inflation was 2.3%.

Headline and core inflation measures (% YoY)

The detail

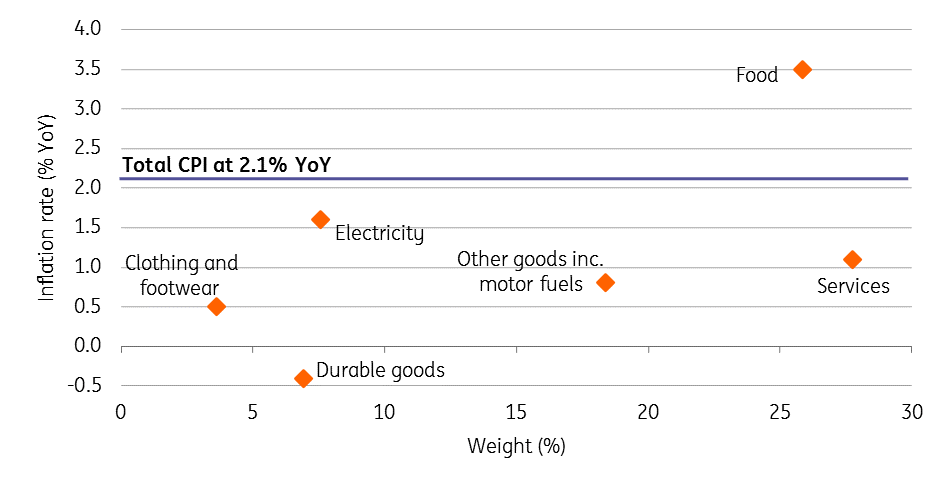

The main factor behind the deceleration of the headline CPI was the slowdown in fuel prices. Due to a strong base effect, prices of fuel increased by just 0.5% YoY, the second lowest rate in 15 months. Hungary's Central Statistical Office registered a 0.4% YoY drop in durable goods prices, another factor behind the slowdown of the headline rate. Inflation in services has finally increased somewhat, counterbalancing the price drop in durable goods, resulting in flat core inflation. Price increases in food, and alcoholic beverages and tobacco were again higher than the average inflation rate.

CPI by main groups in Dec-17

The big picture

All of the indicators were lower than the 3% target in 2017. Looking forward to 2018, we expect inflationary pressures to strengthen somewhat, reaching 2.7% YoY on average. Against this backdrop, we don’t see any change in the recent monetary policy setup. The ultra-loose monetary stance might remain with us in 2018.